The crypto market experienced a massive surge in a surprising turn of events, leaving many caught off guard. However, for those aware of the emergence of exchange-traded funds (ETFs), this uptick was no surprise. Experts suggest that the increased accessibility and exposure of prominent players like Blackrock and others have played a significant role in the market’s recent bullish trend.

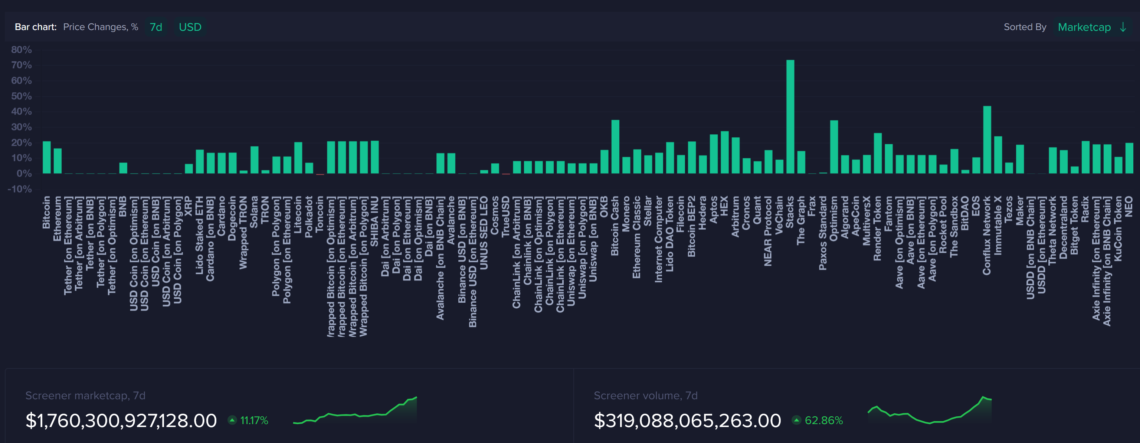

Source: Sanbase

The integration of ETFs into the world of cryptocurrencies has been a game-changer, revolutionizing how investors participate in the digital asset class. Unlike traditional cryptocurrency investments that require navigating complex exchanges and managing private wallets, ETFs provide a more familiar and user-friendly investment avenue. This shift has captured the attention of seasoned crypto enthusiasts and piqued the interest of institutional investors who have been hesitant to enter the volatile crypto space.

Blackrock, one of the world’s largest asset management firms, has been at the forefront of this movement. By embracing the potential of cryptocurrencies and launching crypto-focused ETFs, Blackrock has opened the floodgates for a broader range of investors. The mere involvement of such a reputable financial institution has instilled confidence in the market, leading to a surge in demand for digital assets.

But Blackrock is not alone in this endeavor. Several other major financial institutions, including Vanguard and Fidelity, have also recognized the growing allure of cryptocurrencies. Their foray into the crypto market through ETF offerings has further fueled momentum, attracting retail and institutional investors seeking exposure to this alternative asset class.

The impact of ETFs on the cryptocurrency market cannot be overstated. With the traditional barriers to entry crumbling, a wider audience now has the opportunity to participate in the potential gains offered by digital currencies. This increased accessibility has brought a fresh wave of capital into the market, driving up prices and enhancing overall market liquidity.

As the crypto market continues to mature, the integration of ETFs marks a significant milestone in its evolution. The democratization of crypto investing has set the stage for a new era, where digital assets are no longer confined to a niche group of tech-savvy individuals but become a mainstream investment option.

While the recent market surge may have caught some off guard, those who recognized the potential unleashed by the emergence of ETFs have been able to capitalize on this exciting development. As more financial institutions jump on the bandwagon and embrace cryptocurrencies through ETFs, the market landscape is poised for further transformation. It remains to be seen how this newfound accessibility and exposure will shape the future of cryptocurrencies. Still, one thing is sure: the era of crypto ETFs has arrived, and the crypto market will never be the same again.

Add a Comment