Hashdex, a Brazil-based investment manager, has submitted a proposal to the United States Securities and Exchange Commission (SEC) for a combined spot Bitcoin and Ether ETF on the Nasdaq exchange. This ETF aims to balance the two leading cryptocurrencies according to their market capitalizations.

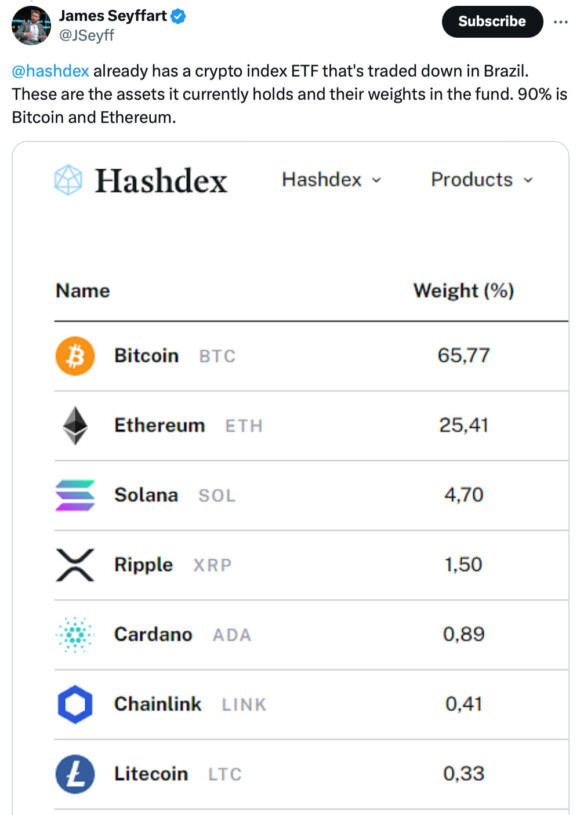

The proposed ETF, detailed in the June 18 filing, plans to allocate assets based on their market weights, with 70.54% in Bitcoin and 29.46% in Ether as of May 27.

Balanced Investment Strategy for the Combined Spot Bitcoin and Ether ETF

The proposed combined spot Bitcoin and Ether ETF will follow a passive investment strategy, tracking the daily movements of the Nasdaq Crypto US Settlement Price Index. The combined spot Bitcoin and Ether ETF will focus solely on BTC and ETH, avoiding other crypto assets.

However, the filing allows for potential inclusion of other digital assets if they meet certain criteria, such as being listed on a U.S.-regulated digital asset trading platform or serving as the underlying asset for a derivative instrument on a U.S.-regulated derivatives platform.

Innovative Approach to Crypto ETFs

James Seyffart, an analyst, commented that a combined-asset ETF “makes a lot of sense.” The ETF will primarily focus on BTC and ETH but includes provisions for incorporating other digital assets as they receive SEC approval. The filing states:

“In the event that any other crypto asset is included (other than bitcoin or ether), or is eligible for inclusion as an Index Constituent […], the Sponsor will transition the Trust’s investment strategy […], with only bitcoin and ether in the same proportions determined by the Index.”

For a crypto asset to be eligible, it must be listed on a U.S.-regulated digital asset trading platform or serve as the underlying asset for a derivative instrument listed on a U.S.-regulated derivatives platform.

Coinbase and BitGo will act as custodians for the BTC and ETH assets in the combined spot Bitcoin and Ether ETF, providing segregated accounts for individual shareholders. This structure ensures a higher level of security and regulatory compliance for the ETF’s holdings.

SEC Approval Process for the Combined Spot Bitcoin and Ether ETF

Hashdex’s proposal will undergo the SEC’s standard review process. They must file and receive approval on an S-1 application, and the SEC has 90 days to respond to the 19-b4, during which it will accept comments from the public and other financial institutions. Seyffart anticipates a final SEC decision on the fund by March 2025.

If approved, the combined spot Bitcoin and Ether ETF would be the first of its kind, combining two major cryptocurrencies in a single investment vehicle. The approval of the combined spot Bitcoin and Ether ETF could pave the way for similar products, potentially broadening the range of investment options in the cryptocurrency market.

Add a Comment