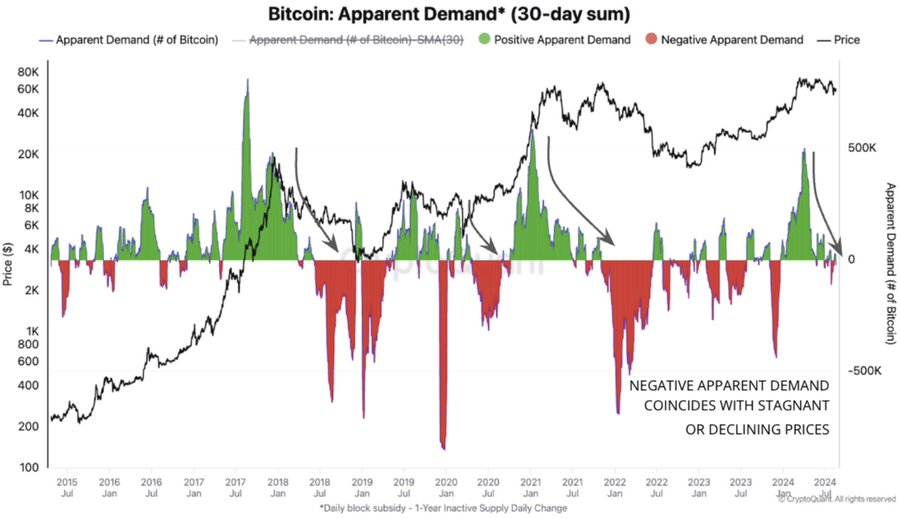

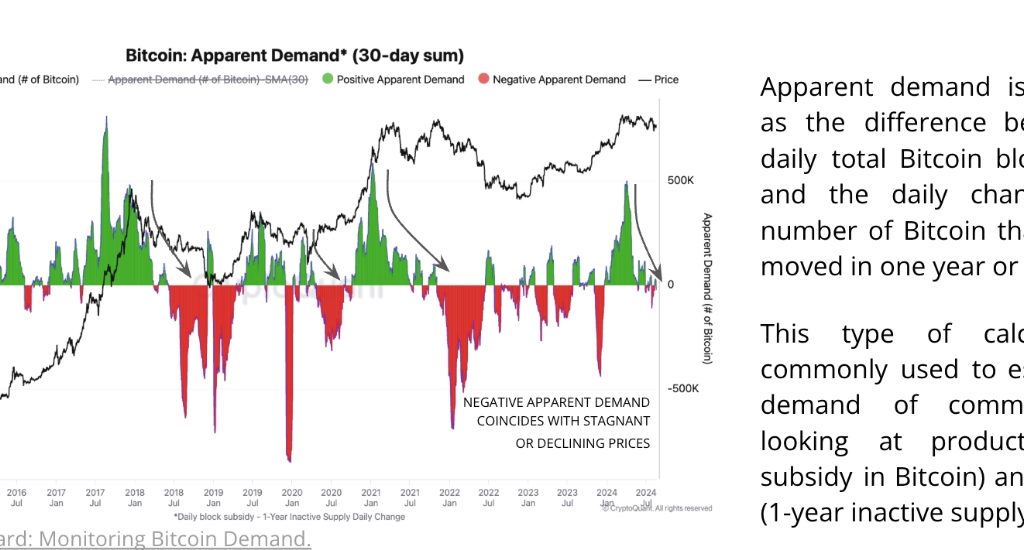

Bitcoin demand growth has experienced a notable decline, reflecting growing caution within the cryptocurrency market. Data from CryptoQuant shows that the apparent demand for Bitcoin, which previously peaked with a 30-day increase of 496,000 BTC in early 2024, has now reversed to a negative growth of 25,000 BTC. This downturn coincides with a price drop from approximately $70,000 to around $49,000, underscoring a broader market retreat.

One of the most prominent indicators of this weakening demand is the decreased activity among U.S.-based spot ETFs. In March, these ETFs were acquiring an average of 12,500 BTC daily. However, this figure has since plummeted to just 1,300 BTC per day. The diminished buying pressure has led to a sharp decline in Bitcoin’s price premium on platforms like Coinbase, where it has fallen from 0.25% earlier this year to a meager 0.01% currently.

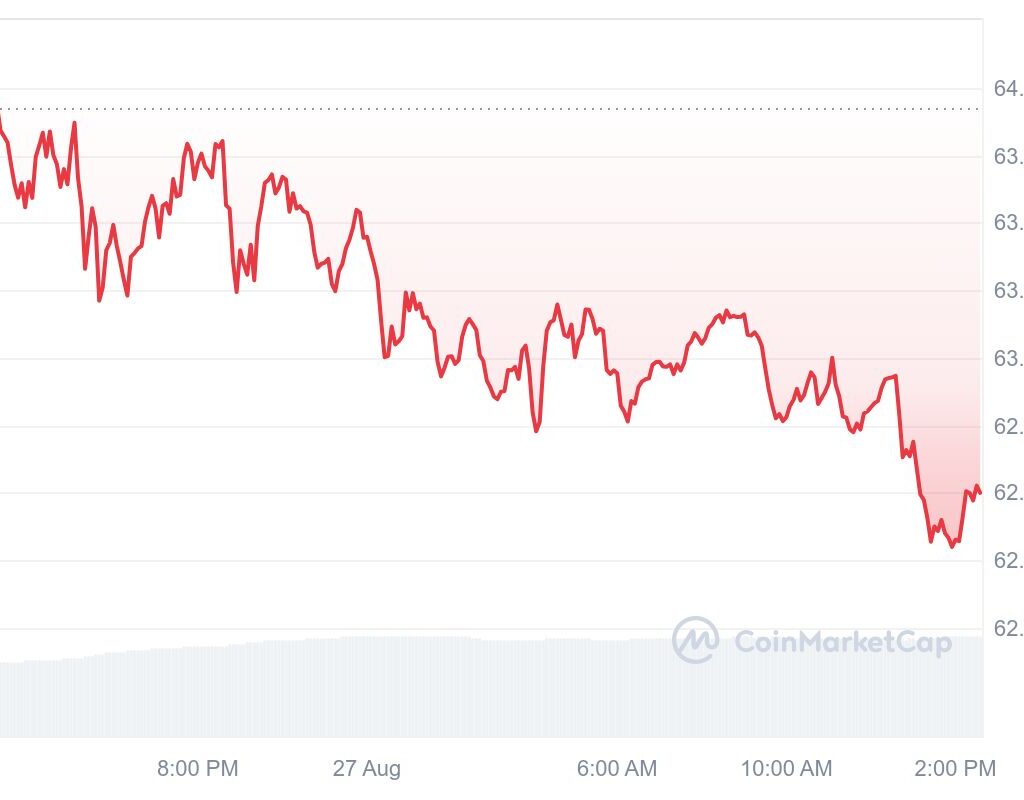

This decline in demand has coincided with a drop in Bitcoin’s price, which currently stands at $62,481.95, down 2.26% in the last 24 hours.

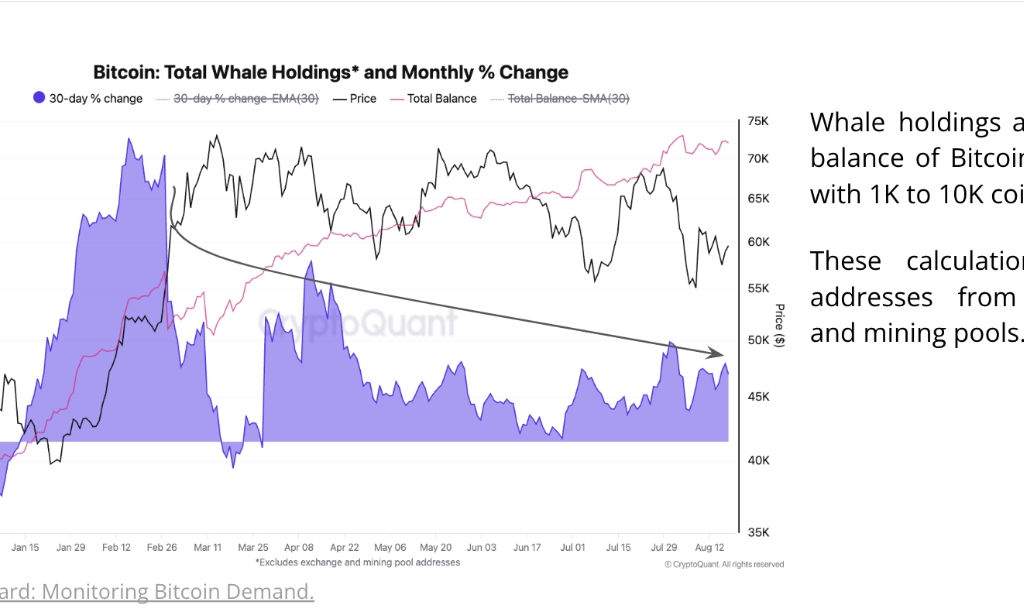

Whale Holdings Reflect a Market in Transition

The decline in Bitcoin demand growth is mirrored in the behavior of large Bitcoin holders, often referred to as “whales.” The 30-day percentage change in whale holdings has slowed drastically, from a robust 6% growth rate in February to just 1% in recent months.

Historically, growth rates above 3% in whale holdings have been linked to rising Bitcoin prices, making the current slowdown a critical signal of the market’s changing dynamics.

Despite the overall decline in demand, permanent holders—those with a long-term investment horizon—continue to accumulate Bitcoin at unprecedented levels. Data reveals that these holders have been adding to their positions at a record-breaking monthly rate of 391,000 BTC. This trend suggests that while short-term traders are scaling back, long-term investors maintain confidence in Bitcoin’s future value.

Moreover, the total market capitalization of stablecoins has reached an all-time high of $165 billion, indicating that liquidity within the crypto market remains strong, even as Bitcoin demand growth falters.

Can Bitcoin Demand Rebound?

The ongoing decline in Bitcoin demand growth raises critical questions about the market’s future. The reduced purchasing activity from spot ETFs and the cautious stance of whales signal a market in transition, with uncertainty at the forefront. However, the persistent accumulation by long-term holders and the surging liquidity in stablecoins offer potential for recovery, provided that market conditions stabilize and demand reignites.

For Bitcoin to regain its upward trajectory, a resurgence in demand, particularly from institutional investors, will be essential. Without renewed interest from major market players, Bitcoin’s price may struggle to recover from its current lows.

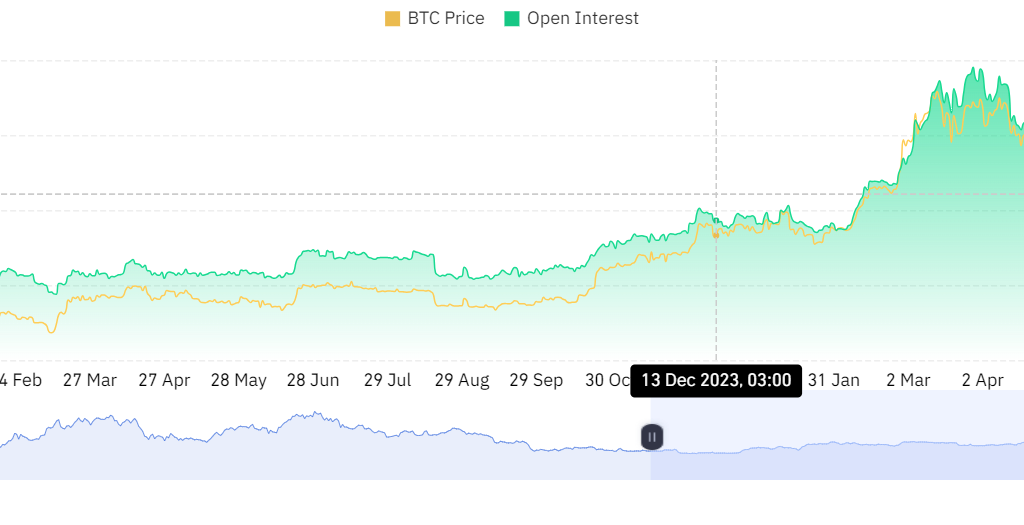

Meanwhile, Bitcoin derivatives trading volume has increased by 21.88% to $52.58 billion, although open interest has decreased by 3.02% to $33.41 billion, indicating cautious market sentiment.

Leave a Reply