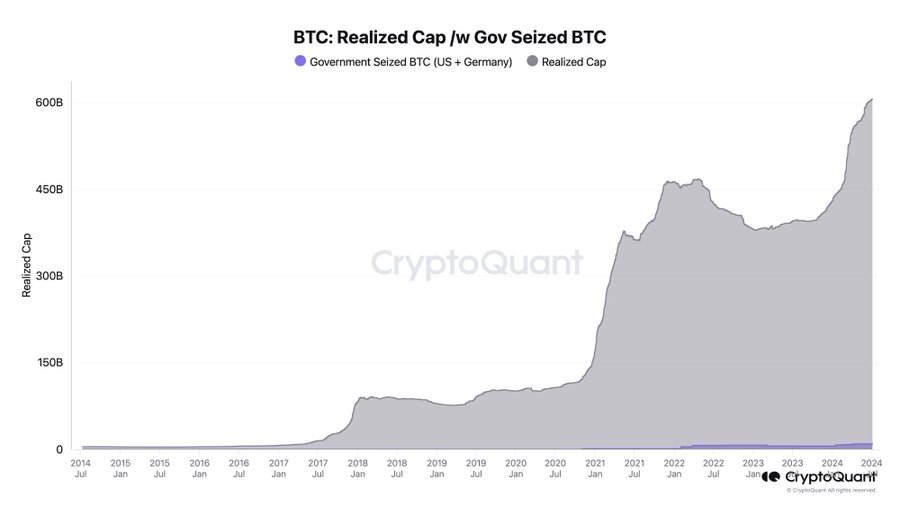

Government Bitcoin (BTC) sales have generated minimal impact on the current bull market, according to CryptoQuant’s Ki Young Ju. The founder and CEO of the onchain analytics platform emphasized that government BTC sell-offs are insignificant compared to the overall inflows in the market.

Ki stated in a post on X that Bitcoin sold by governments represents a fraction of the total market inflows since the latest bull run started in 2023. He highlighted that while governments have sold approximately $9 billion worth of Bitcoin, this amount is negligible against the $225 billion of inflows recorded in the same period.

“Government Bitcoin selling is overestimated,” Ki noted. “$224 billion has flowed into this market since 2023. Government-seized BTC contributes about $9 billion to the realized cap.”

Perspective on Market Stability Amid Sell-Offs

Ki’s analysis comes as a counterpoint to recent market volatility influenced by government BTC sales. Notably, the United States and Germany are among the countries offloading seized Bitcoin. Data from crypto intelligence firm Arkham reveals that Germany still holds 41,200 BTC seized from various sources.

Despite these sell-offs, Ki argues that panic is unwarranted. He pointed out that government sales account for only 4% of the total cumulative realized value since 2023, urging traders not to let fear, uncertainty, and doubt (FUD) driven by government actions disrupt their trading strategies.

“Don’t let government selling FUD ruin your trades,” he advised. “It’s only 4% of the total cumulative realized value since 2023.”

Market Reactions to Government Bitcoin Sales

Despite concerns about government sell-offs, Ju advised traders to stay calm. Recent price movements in Bitcoin, influenced by government sales and transactions from wallets linked to the defunct exchange Mt. Gox, have affected market sentiment. Data from Arkham Intelligence indicates that Germany and the United States are key holders of seized BTC, with Germany still holding 41,200 BTC.

The Crypto Fear and Greed Index shows sentiment nearing “extreme fear,” yet Ju argues that panic over government sales is unjustified. “Don’t let government selling FUD ruin your trades,” he reiterated.

Bitcoin’s Technical Indicators and Support Levels

Bitcoin hit a four-month low of $53,500 on July 5, recovering to around $57,866 the next day. The market remains vigilant over key long-term support levels. The supertrend floor at $52,000 is critical, with potential further declines to $45,000 aligning with historical trends.

The Moving Average Convergence Divergence (MACD) shows a downward trajectory, and the Relative Strength Index (RSI) at 28 indicates oversold conditions. Fibonacci retracement levels place resistance at $64,360 and $70,265, with support around $50,867 and $56,022.

Add a Comment