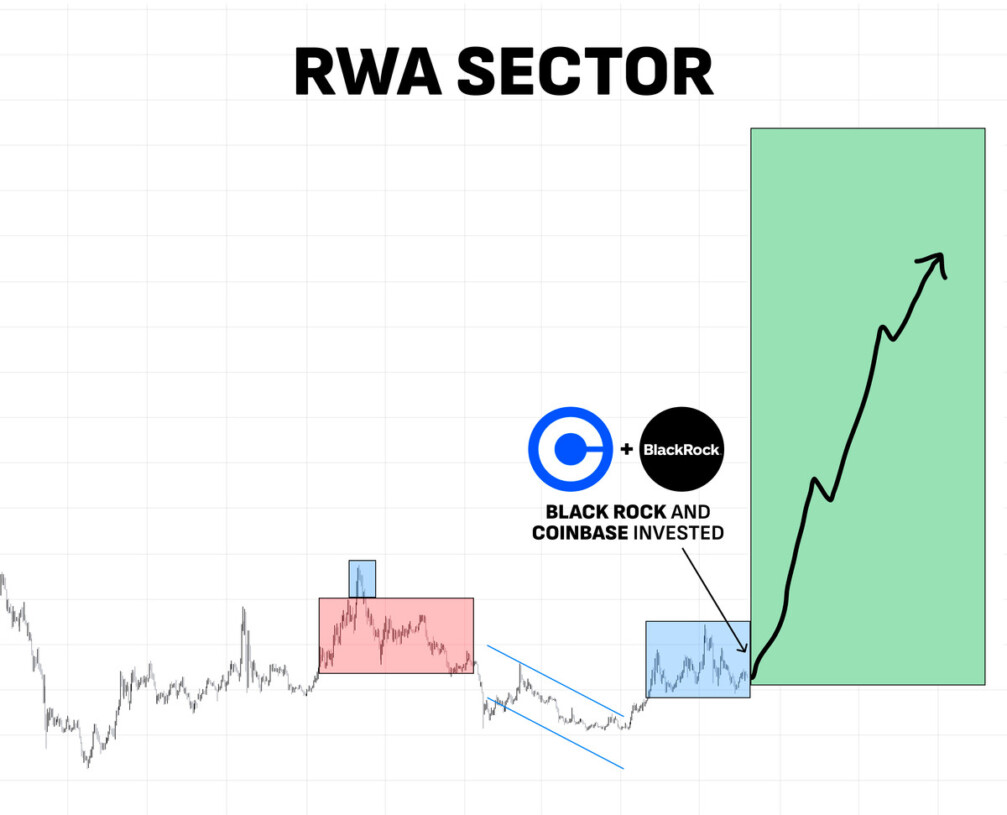

Coinbase and Blackrock have made significant moves into the burgeoning real-world assets (RWA) sector. This shift highlights the growing potential of blockchain-based tokens backed by tangible assets. Cyclop, a crypto researcher, has pinpointed 15 specific RWA-related tokens that may possess 10-100x growth potential.

This surge in RWA interest could benefit several sectors. Real estate, commodities, and even debt instruments can be tokenized, potentially offering fractional ownership, increased liquidity, and more transparent transactions. Blockchain technology adds layers of efficiency and security to what are often complex investment processes.

The Next Frontier in Cryptocurrency

The venture into RWAs by Coinbase and BlackRock is not just an expansion; it’s a testament to the growing intersection between digital and tangible assets. By leveraging blockchain’s transparency and efficiency, they propose a future where real-world assets are as fluid and accessible as cryptocurrencies. This move could democratize access to investments previously reserved for the elite, offering unprecedented opportunities to the average investor.

The partnership’s announcement has already sparked a flurry of activity among investors and industry observers. Past successes, including 300x returns on select cryptocurrency investments, underline the potential of strategic investments in the RWA space. The collaboration is poised to open up new avenues for growth, with a carefully curated list of RWA projects hinting at 10-100x growth potential.

Harnessing Blockchain for Real-World Assets

The integration of blockchain technology with real-world assets offers a compelling narrative of progress and potential. Projects like $TRADE, the world’s leading RWA marketplace, and $IXS, dubbed the Uniswap for Real-World Asset Tokens, exemplify the innovation underway. These platforms aim to streamline the exchange, management, and investment in RWAs, making it easier and more transparent than ever before.

This initiative is expected to significantly impact the RWA market, currently valued at over $56.4 million and projected to reach $16 trillion by 2030. Such growth underscores the immense potential and growing investor interest in bridging the gap between digital finance and tangible assets. By simplifying investment in real estate, art, and more, Coinbase and BlackRock are not just investing in technology; they are reshaping the very fabric of investment strategy.

The entry of Coinbase and BlackRock into the RWA sector marks a pivotal moment in financial history. It signals a shift towards a more inclusive and diversified investment landscape, where blockchain technology serves as the backbone for innovative investment solutions. As these projects unfold, they promise to unlock new value, offer unprecedented access to investments, and potentially redefine wealth generation for the digital age.

Add a Comment