Introduction

In today’s fast-paced cryptocurrency market, traders constantly seek ways to gain an edge and maximize their profits. One approach that has gained popularity is using crypto bot trading strategies. These strategies leverage automated trading bots to execute trades based on predefined rules and algorithms. In this article, we will explore the world of crypto bot trading strategies, covering various types, their benefits, and how they can enhance your trading experience.

Table of Contents

What Are Crypto Bot Trading Strategies?

Crypto bot trading strategies refer to a set of rules and algorithms implemented in trading bots to automate the execution of trades in the cryptocurrency market. These strategies are designed to take advantage of market trends, price differentials, and other indicators to generate profitable trading opportunities. By using crypto bot trading strategies, traders can eliminate the need for manual execution of trades and take advantage of the speed and efficiency offered by automation.

These strategies can be tailored to individual traders’ preferences and risk tolerance, making them an effective tool for improving portfolio returns.

Some of the most popular crypto bot trading strategies include scalping, arbitrage, market making, trend following, and intraday trading. Scalping involves taking small profits over a short period by rapidly opening and closing numerous positions. Arbitrage involves exploiting price differentials between exchanges by buying and selling the same asset at two different prices.

Market making involves providing liquidity by opening buy and sell orders simultaneously, while trend following uses technical analysis to identify profitable entry points based on current market conditions. Lastly, intraday trading relies on taking advantage of short-term volatility in the market by opening and closing positions over a single trading session. Each strategy has advantages and disadvantages, so traders must choose the one that best suits their risk preferences and trading style.

Crypto bot trading can be used with manual trading techniques or as a standalone tool for automated portfolio management. Regardless of how it is used, crypto bot trading strategies provide traders with an effective way to increase their portfolio returns and reduce the time spent on the manual execution of trades. With the right tools and strategies, traders can take advantage of every opportunity available in the cryptocurrency markets.

Importance of Effective Strategies

Effective bot trading strategies are crucial in the world of financial markets and cryptocurrencies. Bots, or automated trading systems, have gained significant popularity due to their ability to execute trades quickly, analyze vast amounts of data, and eliminate human emotions from the trading process. Here are some key reasons why effective bot trading strategies are important:

- Speed and Efficiency: Bots can execute trades at lightning-fast speeds, reacting to real-time market conditions and price movements. They can analyze multiple indicators and make split-second decisions, which can be challenging for human traders. Effective strategies ensure that bots take advantage of price discrepancies, arbitrage opportunities, and other market inefficiencies swiftly and efficiently.

- Elimination of Emotions: Emotions such as fear, greed, and uncertainty can often cloud human judgment, leading to impulsive or irrational trading decisions. Bots, on the other hand, operate based on predefined algorithms and rules, devoid of emotions. Effective strategies enable bots to stick to a disciplined approach, avoiding emotional biases and making consistent decisions based on objective parameters.

- Backtesting and Optimization: A well-designed trading strategy allows for rigorous backtesting, where historical market data is used to simulate the strategy’s performance. By analyzing past data, traders can assess how the strategy would have performed in different market conditions. This process helps refine and optimize the strategy, improving its effectiveness before deploying it in live trading.

- Diversification and Risk Management: Effective bot trading strategies take into account risk management principles. They can incorporate features like portfolio diversification, position sizing, and stop-loss orders to mitigate potential losses. By diversifying across different assets or markets and managing risk effectively, bots can reduce the impact of adverse market movements and protect the trader’s capital.

- Scalability and Consistency: Bots can operate 24/7 without the need for constant monitoring, allowing traders to execute trades even when they are not physically present. Effective strategies enable bots to maintain consistent performance across various market conditions and timeframes. They can be programmed to adapt to changing market dynamics, ensuring scalability and the ability to capture opportunities across different trading scenarios.

- Data Analysis and Market Insights: Bots can analyze vast amounts of data, including price charts, news feeds, social media sentiment, and more. Effective strategies incorporate robust data analysis techniques to identify patterns, trends, and market signals. By leveraging this data, bots can make informed trading decisions and uncover potential trading opportunities that humans might find difficult to spot.

Types of Crypto Bot Trading Strategies

Fundamental Strategies

The world of cryptocurrency trading has grown exponentially in recent years, and with this growth comes an increasing demand for efficient and effective trading strategies. One popular method is using crypto bots, which are automated programs designed to execute trades on behalf of the user. These bots can be programmed to follow various strategies, depending on the trader’s goals and risk tolerance. In this article, we will explore some of the most common types of crypto bot trading strategies, starting with fundamental strategies and moving on to trend-following techniques.

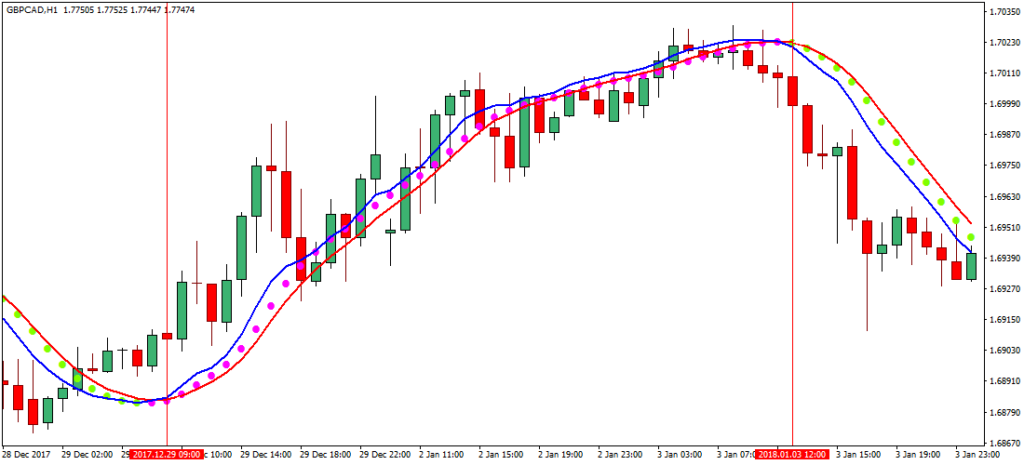

Trend Following

One of the fundamental strategies in crypto bot trading is trend following. It’s like hopping on a trend train and riding it to profitability. In simple terms, this strategy involves analyzing the price movement of a cryptocurrency and identifying trends, whether they’re upward (bullish) or downward (bearish). Once a trend is spotted, your bot can enter a position and ride the wave until the trend shows signs of exhaustion.

For example, let’s say your bot detects a cryptocurrency that has been steadily increasing in value over the past few days. By employing the trend-following strategy, your bot could enter a long position and ride the upward momentum until it senses a potential reversal. This strategy capitalizes on the age-old adage, “The trend is your friend.”

Mean Reversion

Another powerful fundamental strategy in crypto bot trading is mean reversion. Imagine you’re at a party, and someone starts doing the limbo. As they go lower and lower, you instinctively know that they’ll eventually bounce back up. Mean reversion works in a similar way.

In crypto bot trading, mean reversion is based on the belief that prices will eventually return to their average or “mean” value after deviating from it. The strategy involves identifying overbought or oversold conditions in a cryptocurrency and taking positions that anticipate a price correction.

For instance, if your bot detects a cryptocurrency that has experienced a significant price increase quickly, it may indicate an overbought condition. Your bot can then enter a short position, anticipating a pullback as the price reverts to its mean. It’s like playing a game of tug-of-war but with profits on the line.

Technical Strategies

Breakout Trading

Ever heard of the saying, “The early bird catches the worm”? Well, in breakout trading, the early bot catches the profits. This technical strategy involves identifying key support and resistance levels in a cryptocurrency’s price chart. When the price breaks out of these levels, it often signifies a significant shift in market sentiment.

Let’s say your bot identifies a cryptocurrency trading within a tight range for an extended period. By employing the breakout trading strategy, your bot can set buy and sell orders just above and below the range. When the price breaks out of the content, your bot can capture the momentum and potentially ride a profitable trend.

Momentum Trading

Momentum trading is all about hopping aboard the hype train. This strategy capitalizes on the momentum generated by price movements and seeks to capture profits during solid uptrends or downtrends. It’s like joining a parade and marching alongside the market’s most enthusiastic participants.

Imagine your bot detects a cryptocurrency that’s making headlines, capturing the attention of traders worldwide. By employing the momentum trading strategy, your bot can enter a position in the direction of the prevailing trend, aiming to capture substantial gains as the hype and buying pressure continue.

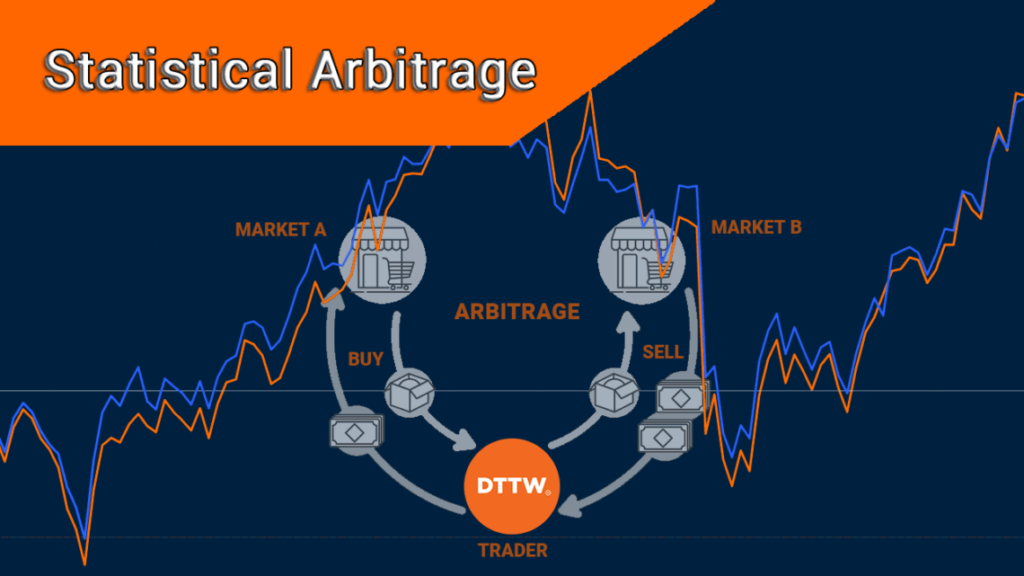

Arbitrage Trading

Who doesn’t love a good deal? In crypto bot trading, arbitrage is the art of capitalizing on price discrepancies between different exchanges or markets. It’s like buying a discounted item in one store and selling it at a higher price in another. Your bot acts as the shrewd shopper, exploiting these price differences to profit.

Arbitrage opportunities can arise due to variations in liquidity, trading volumes, or regional market conditions. Your bot can snatch profits from market inefficiencies by swiftly executing trades across multiple platforms. It’s like being a high-speed trader with a sixth sense of spotting lucrative gaps.

Risk Management and Portfolio Diversification

While strategies can be incredibly lucrative, it’s essential to tread cautiously in the world of crypto bot trading. Managing risk and diversifying your portfolio are critical components of a successful trading journey. Remember, it’s not about putting all your eggs in one basket; it’s about having a diversified omelet.

Implementing risk management measures, such as setting stop-loss orders and allocating appropriate capital, helps protect your investments from unexpected market fluctuations. Diversifying your portfolio by investing in a range of cryptocurrencies spreads the risk and increases your chances of capturing profitable opportunities.

Backtesting and Optimization

In the world of crypto bot trading, knowledge is power, and data is king. Backtesting is a vital step in your journey toward trading mastery. It involves testing your strategies against historical data to evaluate their performance and potential profitability. Backtesting allows you to refine and optimize your strategy, ensuring they’re battle-ready before going live.

By feeding your bot with historical data and simulating trades, you gain valuable insights into how your strategies would have performed in the past. It’s like having a time machine that lets you test your bot’s abilities and fine-tune its decision-making process.

Monitoring and Adjusting Strategies

Like a captain navigating stormy seas, monitoring and adjusting your strategies is crucial in crypto bot trading. The market is ever-changing, and what works today may not work tomorrow. Stay vigilant and adapt to evolving market conditions.

Regularly monitor your bot’s performance, analyze the results, and adjust as needed. Are there new trends emerging? Has market sentiment shifted? Stay informed and be ready to recalibrate your strategies to stay one step ahead of the game.

Common Pitfalls to Avoid

As you venture into the exciting world of crypto bot trading, beware of the common pitfalls that can derail your success. Here are a few to keep in mind:

- Greed: It’s easy to get caught up in the allure of quick profits. Remember to set realistic expectations and avoid letting greed dictate your decisions.

- Impatience: Rome wasn’t built in a day, and neither will your trading empire. Patience is key in navigating the ups and downs of the market.

- Lack of Research: Don’t dive into trades blindly. Conduct thorough research and stay informed about the cryptocurrencies you’re trading.

- Ignoring Risk Management: Protect your investments by implementing proper risk management techniques. It’s better to play it safe than to suffer significant losses.

- Over-Optimization: While optimization is essential, be cautious not to over-optimize your strategies. Strive for a balance between performance and adaptability.

Benefits of Using Crypto Bot Trading Strategies

Implementing crypto bot trading strategies can offer several advantages to traders. Let’s explore some of the key benefits:

- Automation and Efficiency: Crypto bot trading strategies automate the execution of trades, eliminating the need for manual intervention. This enhances efficiency and allows traders to take advantage of opportunities even when away from their screens.

- Emotional Discipline: By relying on predefined rules and algorithms, crypto bot trading strategies remove the emotional aspect from trading decisions. Traders can avoid impulsive and irrational behavior, leading to more disciplined and consistent trading outcomes.

- Backtesting and Optimization: Using historical data to assess their performance, crypto bot trading strategies can be backtested. Traders can optimize their strategies by fine-tuning parameters and evaluating their profitability before deploying them in live trading.

- Diversification: With crypto bot trading strategies, traders can diversify their trading approaches by utilizing different strategies for various market conditions. This helps in spreading risk and capturing opportunities across different trading scenarios.

- Access to 24/7 Markets: The cryptocurrency market operates 24/7, which can be challenging for manual traders. Crypto bot trading strategies can operate round the clock, taking advantage of trading opportunities even during non-traditional trading hours.

Conclusion

Crypto bot trading strategies offer traders a powerful tool to enhance their trading experience in the cryptocurrency market. With automation, efficiency, and access to various strategies, traders can optimize their trading activities and potentially improve their profitability. However, it’s crucial to remember that no strategy guarantees success and continuous monitoring and adaptation are necessary. By understanding the different types of crypto bot trading strategies and their benefits, traders can make informed decisions and navigate the dynamic cryptocurrency market more effectively.

FAQs

Are crypto bot trading strategies suitable for beginners?

Traders of all experience levels can use crypto bot trading strategies. However, beginners are advised to start with simpler strategies and gradually move on to more complex ones as they gain proficiency.

Do I need coding skills to implement crypto bot trading strategies?

While coding skills can be helpful, they are not a prerequisite for implementing crypto bot trading strategies. Many platforms and tools provide user-friendly interfaces for strategy development and deployment.

Are crypto bot trading strategies foolproof?

No trading strategy is foolproof, including crypto bot trading strategies. Market conditions can change rapidly, and strategies need to be continuously monitored and adjusted to adapt to new situations.

Can I use multiple crypto bot trading strategies simultaneously?

Yes, traders can utilize multiple strategies simultaneously to diversify their trading approach and increase their chances of capturing profitable opportunities.

Are there any risks associated with crypto bot trading strategies?

Like any trading activity, crypto bot trading strategies involve risks. Traders should carefully consider factors such as market volatility, slippage, and technical issues when implementing these strategies.

Leave a Reply