Table of Contents

In today’s rapidly evolving world of cryptocurrencies, a new concept has emerged that is making waves in the investment sphere: liquid staking. This innovative approach to staking your crypto assets not only offers the potential for impressive returns, but also introduces a level of flexibility and liquidity previously unseen in the crypto space. In this blog post, we delve into the concept of liquid staking, exploring its benefits, challenges, and the potential it holds for the future of crypto investing. Whether you’re a seasoned investor or a curious enthusiast, join us as we unravel the mysteries of liquid staking and its impact on the ever-changing landscape of cryptocurrency.

Staking is gaining traction as a popular way to earn passive income in the cryptocurrency world. It plays a critical role in the Proof-of-Stake (PoS) consensus mechanism, which numerous prominent blockchains, including Ethereum, have adopted. However, conventional staking has a major drawback: it locks up staked coins for a certain duration, making them illiquid. Enter liquid staking, a game-changing innovation poised to shape the future of crypto investing.

What is Liquid Staking and How it Works

Liquid staking is an innovation within the cryptocurrency realm that addresses a significant drawback of traditional staking in Proof-of-Stake (PoS) blockchains. Typically, traditional staking involves users locking their cryptocurrency to support network security and validate transactions, earning rewards in the process. However, this method renders the staked assets illiquid, meaning they cannot be sold, traded, or utilized in other financial activities until they are unstaked.

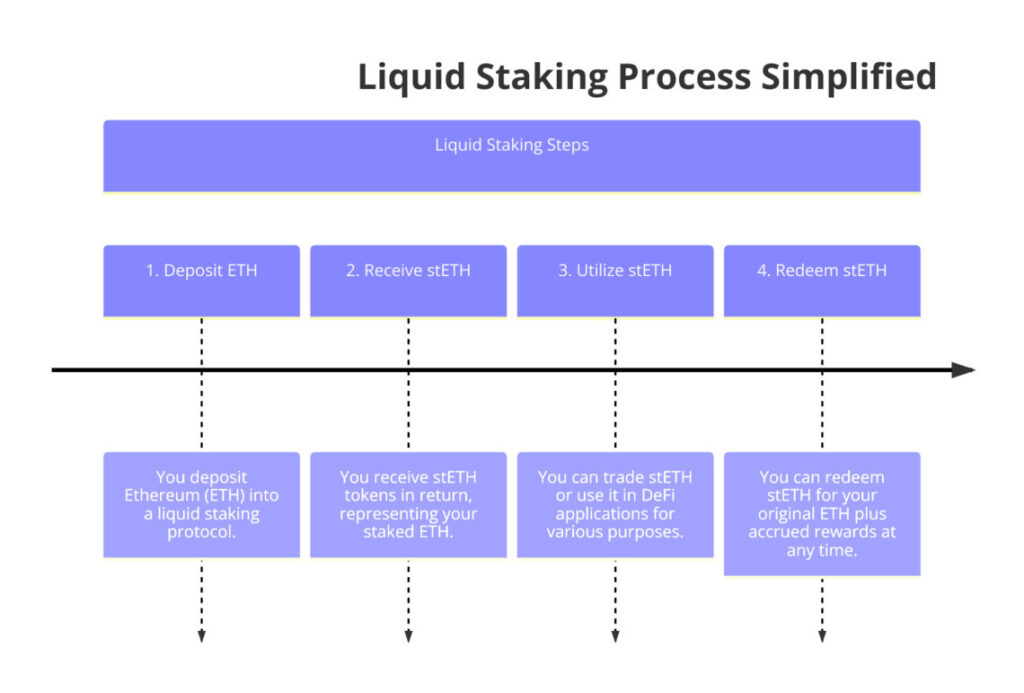

To overcome this limitation, liquid staking protocols introduce a layer of tokenization. Here’s how it works: users deposit their cryptocurrency, like Ethereum, into a liquid staking protocol. Instead of locking the assets, the protocol issues derivative tokens to the users. These tokens are proportional to the amount staked and embody both the initial stake and potential rewards.

These derivative tokens are pivotal as they can be freely traded or used within various decentralized finance (DeFi) applications, such as lending platforms and liquidity pools. This allows users to effectively maintain the liquidity of their staked assets, enabling them to engage in multiple financial operations without sacrificing their participation in staking.

Moreover, at any time, users can redeem their derivative tokens for the original cryptocurrency plus any accrued rewards, according to the specific rules set by the liquid staking protocol. This feature provides flexibility that is absent in traditional staking. However, it also introduces risks related to the smart contract’s integrity and the volatility of the underlying assets.

In essence, liquid staking facilitates the participation in network security and consensus processes of PoS blockchains without the need to sacrifice asset liquidity. This makes it an attractive option for users who wish to maximize their financial activities while contributing to the stability and security of blockchain networks.

The Mechanics of Liquid Staking Protocols

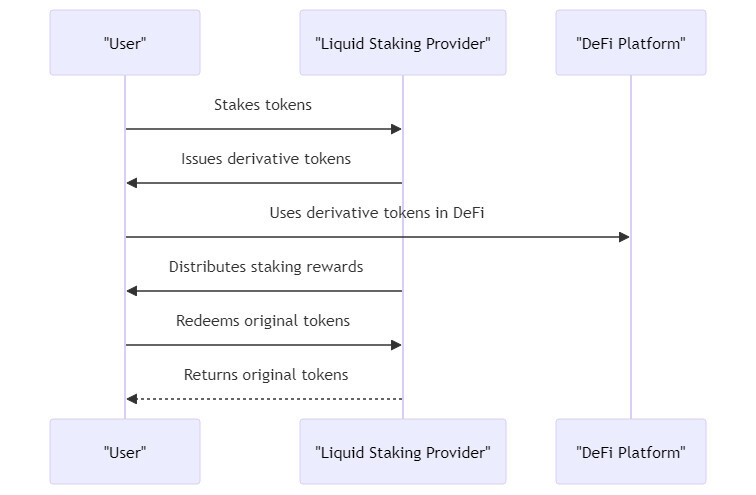

In liquid staking, participants stake their cryptocurrency with a liquid staking provider, but instead of locking up their assets, they receive derivative tokens in return. These tokens represent the staked assets and can be used just like any liquid asset in various decentralized finance (DeFi) activities. This process is depicted in the sequence diagram below, which outlines the steps from staking to token redemption:

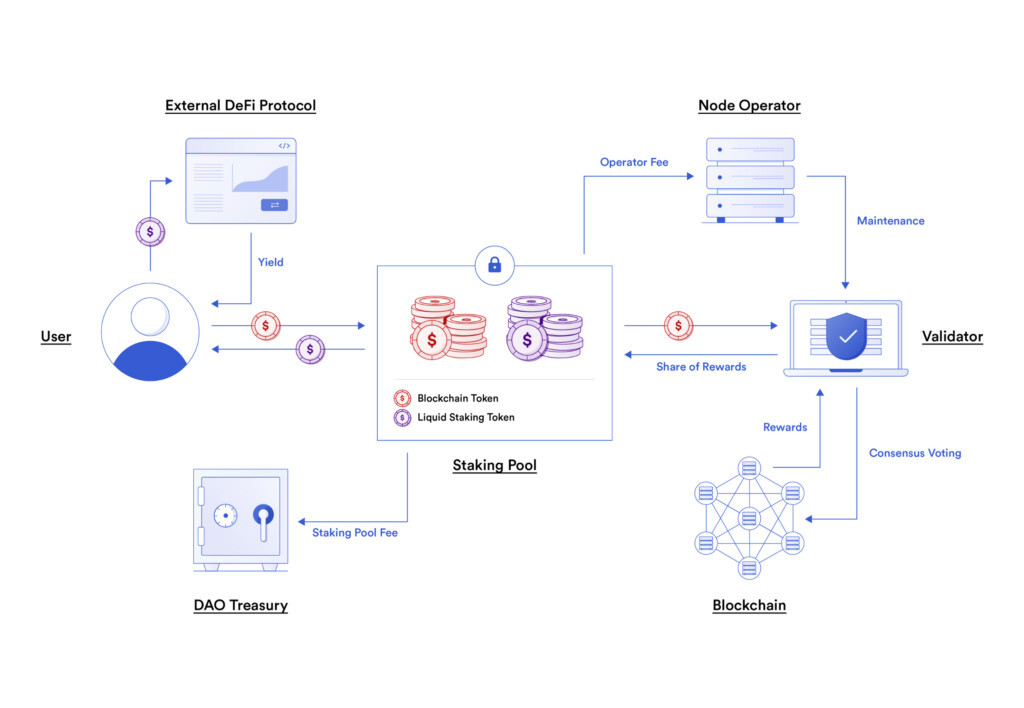

At the core of liquid staking protocols lies a set of smart contracts that facilitate the staking process and token generation. When users deposit their cryptocurrency into the protocol, the assets are pooled together and staked on the underlying blockchain network. In return, users receive liquid staking tokens that represent their share of the staked assets and the associated staking rewards.

These liquid staking tokens can be traded on decentralized exchanges (DEXs) or used within the DeFi ecosystem, enabling users to unlock the value of their staked assets without sacrificing the potential rewards. Liquid staking protocols typically charge a small fee for their services, which is deducted from the staking rewards earned by the users.

Exploring the Dynamic World of Liquid Staking Protocols

Liquid staking protocols are revolutionizing the way investors interact with blockchain assets, combining the benefits of traditional staking with unprecedented liquidity. These protocols allow participants to stake cryptocurrencies while retaining the ability to use their assets in decentralized finance (DeFi) activities. Below, we delve into some of the key players and their innovative approaches that are shaping the landscape of liquid staking.

Lido: Leading the Charge in Liquid Staking

Lido stands at the forefront with a staggering $29.46 billion in total value locked (TVL). Despite a recent dip of 7.35%, Lido continues to innovate across multiple blockchains including Ethereum, Solana, and Moonbeam. It simplifies the staking process by issuing stETH, allowing users to stay liquid and engage actively in the DeFi ecosystem. Lido’s broad blockchain support exemplifies its commitment to accessibility and diversity in crypto investments.

Rocket Pool: Democratizing Ethereum Staking

Rocket Pool marks its presence with a focus on decentralization and accessibility, boasting a TVL of $3.74 billion. It’s unique in that it reduces the entry barriers for becoming a node operator, requiring significantly less capital compared to traditional staking methods. This approach not only fosters wider community participation but also enhances the protocol’s resilience and trustworthiness.

Binance Staked ETH: Integrating Exchange and Staking

Binance has ventured into staking with its Binance Staked ETH, accumulating a TVL of $2.81 billion. It supports Ethereum and BNB Chain, providing users with a seamless way to stake directly through the exchange. This service combines the reliability of a major exchange with the flexibility of liquid staking, offering an attractive option for both novice and seasoned traders.

Jito and Mantle LSP: Niche Players with Robust Offerings

Jito, focusing exclusively on the Solana blockchain, has gathered a TVL of $1.52 billion. It caters to users seeking optimized yields and heightened security within Solana’s ecosystem. Close on its heels is Mantle LSP, with a TVL of $1.51 billion, which has carved out a niche in Ethereum’s crowded staking landscape. Both protocols showcase tailored solutions that address specific blockchain dynamics and user needs.

Emerging Protocols: Innovating Against the Odds

Marinade Finance, Swell Network, Frax Ether, Stader, and StakeStone are part of a group of emerging protocols that collectively manage billions in assets, despite facing fluctuations in their TVLs due to market volatility. They are pioneering new ways to enhance liquidity and user engagement in staking. For instance, Marinade Finance offers automated staking solutions on Solana, while Stader extends its services across multiple blockchains, ensuring flexibility and a broad market appeal.

These liquid staking protocols are more than just facilities for locking up digital assets; they are gateways to a more fluid and dynamic form of financial engagement in the crypto space. Each protocol brings unique innovations to the table, driving forward the integration of blockchain technology into mainstream finance. As the landscape evolves, they continue to offer compelling opportunities for investors looking to maximize returns while maintaining flexibility in their digital asset portfolios.

These protocols illustrate the diverse and rapidly evolving field of liquid staking, each contributing to a more flexible and accessible staking ecosystem. As the demand for such solutions grows, these platforms are at the forefront of offering innovative ways to engage with and benefit from blockchain technology.

How Liquid Staking is Revolutionizing DeFi Investments

Liquid staking has become a significant segment within the cryptocurrency market, offering a solution to the liquidity issues traditionally associated with staking in Proof-of-Stake (PoS) networks. It allows users to stake their cryptocurrencies and receive derivative tokens in return, which can then be used in various decentralized finance (DeFi) applications. This mechanism not only maintains the benefits of staking, such as earning rewards for contributing to network security, but also allows the staked assets to remain liquid and usable.

As of late 2023, the Total Value Locked (TVL) in liquid staking protocols has seen a dramatic increase, growing 5,870% since January 2023 to reach $919 million by August. This growth underscores the booming interest and trust in liquid staking as a viable financial activity within the DeFi space.

In terms of market dominance, Lido stands out as a leading protocol with over $11 billion in TVL, controlling a significant portion of the Ethereum liquid staked market. Despite its success, there are concerns within the community regarding the centralization risks this might pose, as a single entity holding a large share could potentially influence network decisions or become a target for network attacks.

Rocket Pool is another notable player, known for its focus on decentralization. It offers a lower entry barrier compared to traditional staking methods, requiring as little as 16 ETH to become a node operator. This approach is designed to encourage broader participation and support a more decentralized network structure.

Overall, liquid staking protocols are reshaping the staking landscape by mitigating the liquidity constraints of traditional staking and facilitating increased participation in PoS networks. This not only enhances the security of these networks but also expands the utility and efficiency of the staked assets.

Benefits of Liquid Staking

Liquid staking protocols offer a range of benefits that make them attractive to both individual investors and institutional players in the crypto market:

- Increased Liquidity: By enabling the free trading and utilization of staked assets, liquid staking protocols solve the liquidity problem inherent in traditional staking mechanisms. Users can now participate in staking while retaining the ability to access their assets when needed.

- Diversification Opportunities: Liquid staking tokens can be easily integrated into various DeFi applications, such as yield farming, liquidity provision, and lending protocols. This opens up new avenues for users to diversify their portfolios and generate additional returns beyond just staking rewards.

- Capital Efficiency: Staking is often seen as a passive investment strategy, but liquid staking allows users to maximize the utilization of their capital. Instead of keeping assets idle during the staking period, users can leverage their liquid staking tokens to generate additional yield through DeFi platforms.

- Accessibility and Inclusivity: Liquid staking protocols lower the barrier to entry for smaller investors by enabling fractional staking. Users can stake even a small amount of cryptocurrency and benefit from the associated rewards, fostering greater inclusivity in the staking ecosystem.

- Institutional Adoption: The flexibility and capital efficiency offered by liquid staking protocols make them attractive to institutional investors seeking exposure to staking rewards while maintaining liquidity. This could drive increased adoption and liquidity in the liquid staking market.

Liquid Staking Tokens and Crypto Derivatives

The emergence of liquid staking tokens has significantly impacted the cryptocurrency market by facilitating the creation of new derivative products and enhancing trading opportunities. These tokens serve as the backbone for various derivative instruments such as futures, options, and other complex financial products, enabling both speculation on the value of staked assets and hedging strategies.

Integration into Derivative Markets

Liquid staking tokens are essentially representative tokens issued to stakers, which reflect the underlying staked cryptocurrency plus earned rewards. Platforms like Lido and Rocket Pool have popularized these tokens by providing them in exchange for staked ETH, allowing holders to retain liquidity and engage actively in the DeFi ecosystem. For example, Lido issues stETH, which represents staked ETH on Ethereum, enabling users to use it across various DeFi platforms (Cointelegraph, Crypto Bulls Club).

Broader Financial Products

These tokens can be used as underlying assets for derivative products in the crypto market. They can be traded on decentralized exchanges, used as collateral for loans, or incorporated into structured financial products. This adaptability allows investors to hedge their positions or speculate on future price movements without needing to liquidate the underlying staked assets.

Furthermore, liquid staking tokens are being integrated into more structured products like exchange-traded funds (ETFs) and exchange-traded notes (ETNs). This integration offers traditional investors an avenue to gain exposure to the staking ecosystem without the complexities of directly managing cryptocurrencies. It represents a bridging of the gap between traditional finance and decentralized finance, offering a form of participation that is both accessible and compliant with financial regulations.

These developments reflect a broader trend of convergence between decentralized finance and traditional financial markets, providing a robust framework for liquidity and enhanced yield generation through staking activities. As the market for these derivatives grows, it continues to attract more traditional financial entities and investors, looking to diversify into crypto assets while managing potential risks effectively.

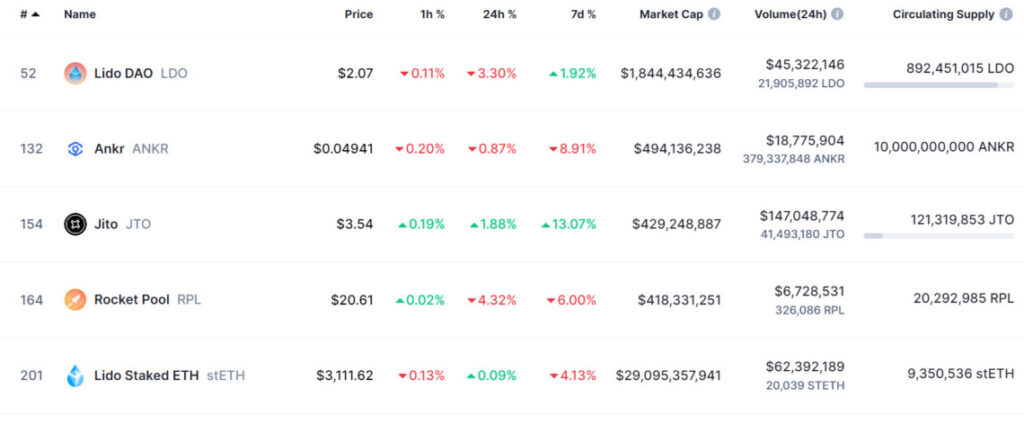

Market Growth and Potential

The liquid staking tokens market has seen significant growth, with a current total market capitalization of around $42.4 billion. This market experienced a 3.4% increase in value over the last 24 hours, accompanied by a trading volume of approximately $243.7 million during the same period.

Among the top liquid staking tokens by market capitalization, Lido Staked Ether (STETH) takes the lead with a market cap of over $29 billion. STETH represents staked Ethereum on the Lido platform and has seen a 0.3% price increase in the past 24 hours and a 4% gain over the last week.

Following closely is Renzo Restaked ETH (EZETH), with a market capitalization of around $3 billion. This token, representing staked Ethereum on the Renzo platform, has experienced a 0.2% price increase in the last 24 hours and a 3.8% gain in the past week.

Rocket Pool ETH (RETH), another prominent liquid staking token for Ethereum, ranks third with a market cap of over $1.7 billion. RETH has seen a 0.2% price increase in the last 24 hours and a 4.1% gain over the past week.

Other notable liquid staking tokens in the top ranks include Mantle Staked Ether (METH) with a market cap of around $1.5 billion, and Marinade Staked SOL (MSOL) for the Solana blockchain, with a market capitalization of over $900 million.

The liquid staking tokens market continues to gain traction, offering investors the ability to participate in staking rewards while maintaining liquidity and enabling the creation of various derivative products and trading opportunities within the cryptocurrency ecosystem.

The Rise of Liquid Staking Protocols

The rise of liquid staking protocols marks a significant evolution in the cryptocurrency and decentralized finance (DeFi) landscapes. These protocols offer a compelling alternative to traditional staking methods by enabling liquidity and flexibility for staked assets. This development has been especially notable with the adoption of Proof of Stake (PoS) mechanisms in major blockchains like Ethereum.

Key Players and Innovations

Platforms like Lido and Rocket Pool have become leaders in this space. Lido, for example, dominates with a significant market share, offering staking services for Ethereum and several other PoS blockchains. It allows users to stake their assets and receive stETH, a tokenized version of their staked ETH, which can be used in various DeFi applications. This model provides users with the flexibility to utilize their staked assets without needing to unstake, thus maintaining liquidity.

Rocket Pool distinguishes itself by promoting decentralization in its staking approach. It lowers the barriers to entry for becoming a node operator, requiring less capital compared to traditional solo staking methods. This has broadened participation in Ethereum’s staking ecosystem, making it more accessible to a diverse group of investors.

Market Impact

The introduction of liquid staking protocols has significantly influenced the DeFi sector by increasing the capital efficiency of staked assets. These protocols allow stakers to participate in other yield-generating activities without sacrificing their staking rewards. Consequently, this has led to an increase in the total value locked (TVL) in DeFi protocols, as staked assets can now be simultaneously used as collateral or in lending protocols.

Challenges and Considerations

Despite their benefits, liquid staking protocols face challenges such as regulatory scrutiny and the risks associated with centralization. For instance, protocols like Lido, which hold a large proportion of staked ETH, raise concerns about potential centralization risks within the Ethereum network. Additionally, the reliance on smart contracts and the complexity of the staking derivatives introduce potential vulnerabilities, including smart contract bugs and security breaches.

Future Prospects

Looking ahead, the landscape of liquid staking protocols is expected to evolve with further innovations and possibly more stringent regulatory frameworks. As the technology matures and more safeguards are implemented, these protocols are likely to become a cornerstone of the DeFi ecosystem, providing a balanced approach to staking that supports both security and liquidity.

How Liquid Staking Enhances Liquidity

Liquid staking significantly amplifies liquidity within the DeFi and blockchain ecosystems by allowing the same capital to be reused for multiple transactions. Unlike traditional staking, where locked funds remain idle within DeFi protocols, liquid staking protocols enable these locked assets to continue circulating, thereby boosting the overall economic activity. This process not only accelerates ecosystem growth but also facilitates increased capital efficiency.

The immense liquidity is partly due to the ability of liquid staking tokens (LSTs) to be used in various DeFi applications. For instance, staked Ethereum (ETH) can be transformed into stETH tokens, which can then be utilized across DeFi platforms such as Compound, Uniswap, and Balancer to generate further yields. This process effectively allows holders to earn dual returns: one from the staking itself and another from DeFi activities.

Currently, the total value of crypto assets engaged in liquid staking protocols stands at approximately $14 billion, marking it as one of the largest categories in the DeFi sector. This robust engagement is propelled by the continuous growth of Proof of Stake (PoS) networks and a general trend towards more fluid staking solutions which promise higher token price appreciations and broader protocol adoption.

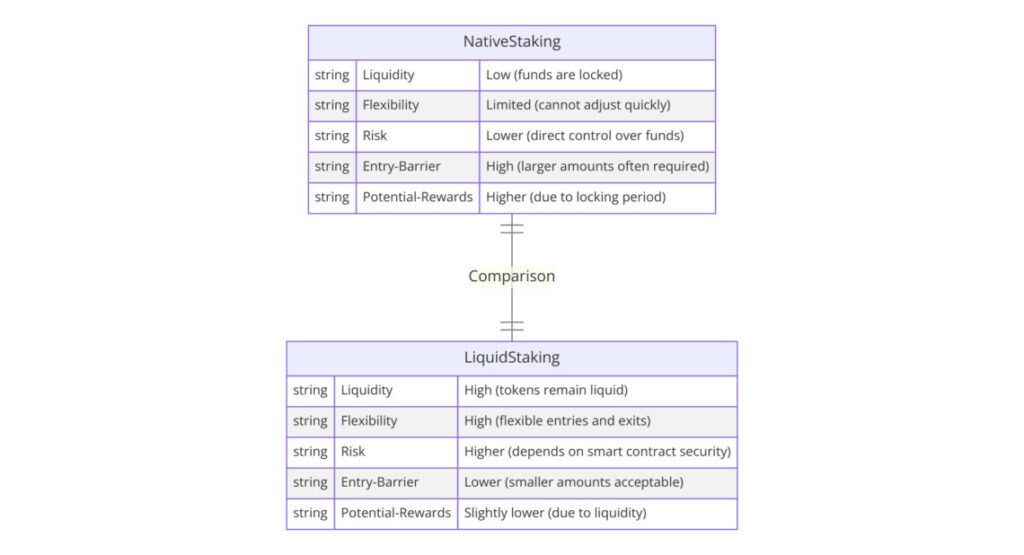

Liquid Staking vs. Native Staking: Enhancing Flexibility and Liquidity

In the evolving landscape of cryptocurrency investments, staking represents a fundamental mechanism for users to earn passive income while contributing to the network’s security and efficiency. However, traditional native staking and the more recent liquid staking vary significantly in their approach and benefits. Understanding these differences is crucial for investors looking to optimize their staking strategies.

Native Staking: The Conventional Approach

Native staking involves locking up cryptocurrency tokens in a wallet to support the operations of a blockchain network. In return, stakers are rewarded with interest or additional cryptocurrency. This process is pivotal in Proof of Stake (PoS) networks, where it serves as a method to validate transactions and maintain the network’s integrity.

Key Characteristics of Native Staking:

- Asset Lock-up: Tokens are locked and cannot be accessed until the end of the staking period, which can restrict liquidity.

- Fixed Rewards: Returns are typically predictable, with stakers knowing the percentage of rewards they will receive over the staking duration.

- Security Contribution: By locking tokens, stakers help secure the network, reducing the likelihood of fraudulent transactions.

Flexibility and Immediate Liquidity

Liquid staking addresses one of the primary limitations of native staking: the lack of liquidity. It allows stakers to participate in network security while also enjoying immediate access to their staked assets through tokenization.

Key Characteristics of Liquid Staking:

- Tokenization: Stakers receive derivative tokens in exchange for the assets they stake. These tokens represent the staked assets and can be used just like cash.

- Increased Liquidity: Unlike native staking, liquid staking does not lock up assets in the same way. Stakers can trade, sell, or use their derivative tokens in other DeFi applications.

- Flexibility: Liquid staking allows users to enter and exit their positions more fluidly. They can adjust their staking based on market conditions without waiting for a lengthy unbonding period.

Comparative Analysis: Risk and Return

While both staking methods offer benefits, they also come with their own sets of risks and rewards:

- Market Risks: Liquid staking derivatives are subject to market conditions and can fluctuate in value differently from the native tokens, potentially leading to losses if the derivatives devalue.

- Operational Risks: Native staking is typically more straightforward and may be perceived as safer for less tech-savvy users, as it involves fewer steps and less exposure to complex DeFi platforms.

Choosing the Right Staking Strategy

The choice between liquid staking and native staking depends on several factors:

- Liquidity Needs: If immediate access to funds is important, liquid staking offers an advantage.

- Risk Tolerance: Investors who prefer a more stable, predictable return may favor native staking.

- Engagement Level: Active participants in the DeFi ecosystem might find liquid staking more beneficial due to the additional opportunities it presents.

While native staking remains a solid choice for those seeking a more traditional, perhaps safer investment path, liquid staking offers a compelling alternative for those desiring greater flexibility and liquidity. As the blockchain landscape continues to evolve, the choice between these staking methods will increasingly depend on individual financial goals and market dynamics.

DeFi and Liquid Staking: A Synergistic Relationship

DeFi (decentralized finance) and liquid staking have developed a synergistic relationship in the cryptocurrency ecosystem. DeFi refers to financial applications built on blockchain technology that allow users to lend, borrow, trade, and earn interest in a permissionless and transparent manner.

Liquid staking emerged as a way for cryptocurrency holders to earn staking rewards without locking up their assets for extended periods. Staking involves committing tokens to help validate transactions on a proof-of-stake blockchain in return for rewards. Traditionally, staked assets were illiquid and unusable until unstaked.

Liquid staking protocols like Lido and Rocket Pool enable users to receive liquid staking derivatives (like stETH or rETH) that represent their staked assets but are transferable. This allows them to use these tokens across DeFi platforms for lending, borrowing, yield farming, and more while continuing to earn staking rewards.

The integration creates lucrative yield opportunities in DeFi by unlocking the liquidity of staked assets. Users can efficiently compound rewards and maximize returns. It also improves capital efficiency by preventing assets from being idle while staked.

The Future of Liquid Staking

As the crypto market continues to mature, liquid staking is poised to play a pivotal role in shaping the future of staking and unlocking new opportunities in the DeFi space. By addressing the liquidity limitations of traditional staking mechanisms, liquid staking protocols have the potential to drive increased participation, capital efficiency, and innovation within the crypto ecosystem.

Looking ahead, we can expect to see further developments in liquid staking protocols, including improved decentralization, enhanced security measures, and better integration with other DeFi platforms. Additionally, the advent of new blockchain networks and consensus mechanisms may spur the creation of liquid staking solutions tailored to their specific requirements.

Conclusion

Liquid Staking is a promising option for crypto investors, allowing them to stake their assets while maintaining liquidity. This unique approach offers the opportunity to earn passive income without sacrificing flexibility. As institutional adoption of cryptocurrencies grows, liquid staking protocols could play a crucial role in facilitating institutional participation in staking and providing exposure to staking rewards through regulated investment vehicles. Explore the benefits and potential risks of liquid staking as the crypto industry continues to evolve, revolutionizing the way we invest in cryptocurrencies.

FAQs

1. What is liquid staking in cryptocurrency?

Liquid staking is a process that allows cryptocurrency holders to stake their assets in a proof-of-stake network while retaining liquidity. Instead of locking assets in a traditional staking agreement, liquid staking issues a derivative token in return, which can be used for other transactions or trading.

2. How does liquid staking differ from traditional staking?

In traditional staking, your crypto assets are locked up, making them unavailable for other uses until you unstake them. Liquid staking, on the other hand, provides you with a staking derivative, representing your staked assets. This derivative can be traded or used in decentralized finance (DeFi) applications, offering liquidity even while your assets are staked.

3. What are the benefits of liquid staking?

The primary benefit of liquid staking is liquidity. Users can participate in staking and earn rewards without giving up access to their assets. This flexibility allows for better capital efficiency. Additionally, liquid staking can reduce the risks of price volatility and enhance yield opportunities through other DeFi activities.

4. Are there risks associated with liquid staking?

Yes, liquid staking involves several risks, including smart contract vulnerabilities, liquidity issues of the derivative tokens, and potential regulatory changes. Users should carefully evaluate these risks and the credibility of the staking platform they choose to use.

5. Can liquid staking improve network security?

Yes, by enabling more participants to stake their assets without locking them up, liquid staking can potentially increase the total amount staked on a network. This increased participation can enhance the security and decentralization of a blockchain network.

6. What happens to my staked assets if the price drops significantly?

If the price of the staked assets drops, the value of the derivative tokens typically drops as well. However, since the assets are still staked, you will continue to earn staking rewards based on the original terms, which may offset some of the price-driven losses.

7. How do I get started with liquid staking?

To begin liquid staking, choose a reputable staking provider that supports liquid staking. Deposit your cryptocurrency into the provider’s staking contract, and receive the corresponding derivative tokens. These tokens can be held or used in various DeFi platforms to generate additional yield.

Leave a Reply