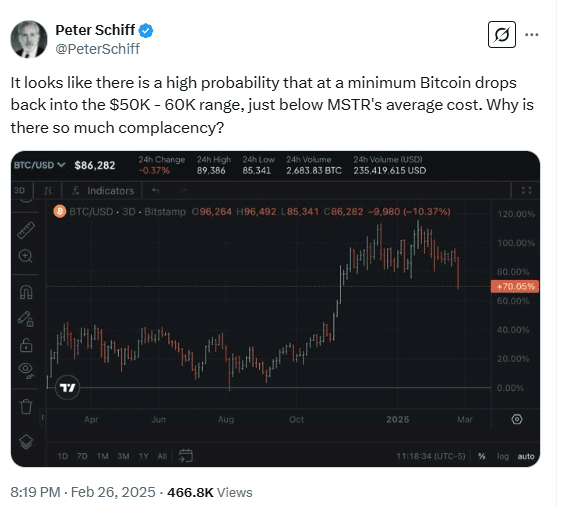

Bitcoin has dropped over 25% from its January peak of $107,500 to a low of $78,812, currently trading at $79,137. The decline has raised concerns, with Peter Schiff predicting Bitcoin could fall to $50,000. Schiff links Bitcoin’s surge to Donald Trump’s economic policies, arguing that they created artificial demand and encouraged speculative trading. He believes that traders who held Bitcoin at its peak missed key opportunities to secure profits.

Peter Schiff Links Bitcoin’s Surge to Trump Policies

Schiff claims that Trump’s economic approach inflated Bitcoin’s value, leading to an unsustainable rise. In a post on X, he described the situation as a speculative bubble that could soon burst. His prediction of a drop to $50,000-$60,000 aligns with MicroStrategy’s average Bitcoin acquisition price, raising concerns about market stability. Traders who did not sell at Bitcoin’s peak could face substantial losses if the decline continues.

– Advertisement –

Bybit Security Breach Raises Crypto Market Concerns

A security breach at Bybit, a major cryptocurrency exchange, has added to market uncertainty. The breach was traced to malicious code from Safe{Wallet}, highlighting vulnerabilities in third-party integrations. Although Bybit reassured users that funds remained secure, the incident exposed weaknesses within crypto infrastructure. Such breaches create doubt among investors, contributing to Bitcoin’s price fluctuations and increasing concerns over asset security.

Bitcoin Price Analysis: What Analysts Say?

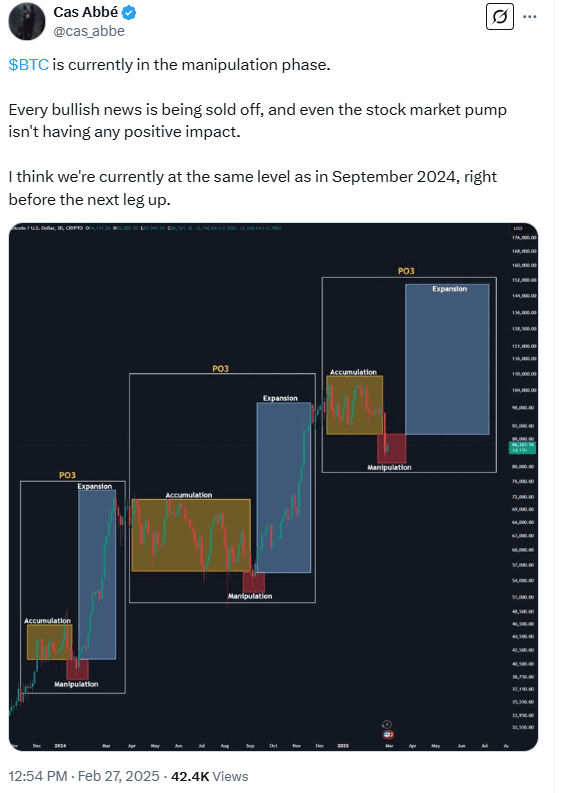

Analyst Cas Abbé posted on X that Bitcoin is in a manipulation phase, where bullish news is being sold off without any positive market reaction. He compared the current price action to September 2024, suggesting that Bitcoin is at a similar level just before a major upward move. His chart outlines a pattern of accumulation, manipulation, and expansion, hinting that Bitcoin could break out after this consolidation period.

Analyst Ali Charts shared on X that Bitcoin’s social sentiment has shifted significantly, which, based on past trends, has historically created strong opportunities for contrarian traders. His analysis shows that sentiment-driven volatility could provide key entry points for traders looking to take positions against the broader market sentiment.

– Advertisement –

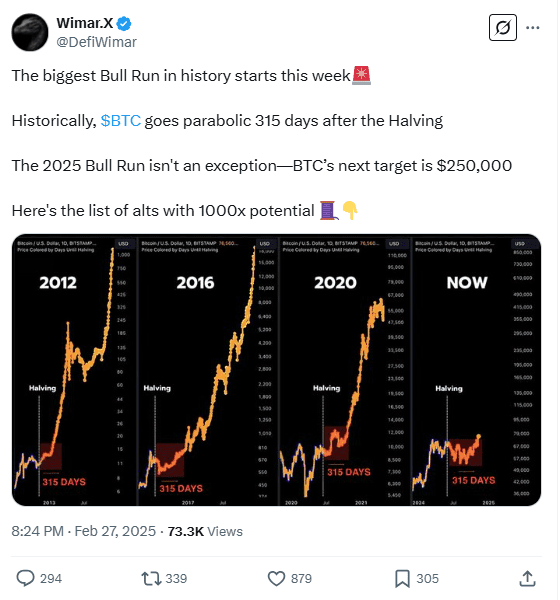

Analyst Wimar.X wrote on X that Bitcoin is set for a historic bull run, citing a 315-day post-halving pattern seen in previous cycles. He suggests that Bitcoin’s next target is $250,000, following the 2024 halving event. His analysis points to Bitcoin repeating its historical pattern, where major price increases have followed previous halving events.

Above all, Bitcoin remains under pressure, with Schiff’s $50,000 prediction gaining attention. The Bybit security breach adds further risks, while technical indicators suggest continued volatility.

Leave a Reply