On July 13, 2023, a pivotal court ruling in the Securities and Exchange Commission (SEC) case against Ripple Labs determined that XRP, Ripple’s cryptocurrency, is not a security. This Ripple vs. SEC decision has significant implications for the cryptocurrency market and regulatory landscape in the United States.

Ripple vs. SEC Brings Legal Clarity for the Cryptocurrency Market

The court’s decision marked a significant victory for Ripple and set a crucial precedent for classifying cryptocurrencies. The SEC initially sued Ripple in December 2020, alleging that the company conducted an unregistered securities offering by selling XRP. Ripple argued that XRP should be considered a currency rather than a security. After a prolonged legal battle, the court sided with Ripple, providing much-needed regulatory clarity in the Ripple vs. SEC case.

The court’s decision that XRP is not a security has had far-reaching consequences for the cryptocurrency industry. It provided much-needed regulatory clarity. Cryptocurrencies have often operated in a gray area, with regulatory agencies struggling to classify and regulate them appropriately.

By ruling that XRP is not a security, the court established a precedent that could influence how other cryptocurrencies are viewed and regulated. This ruling also had a positive impact on XRP’s market value. TradingView data shows XRP’s price surged nearly 6% after the decision.

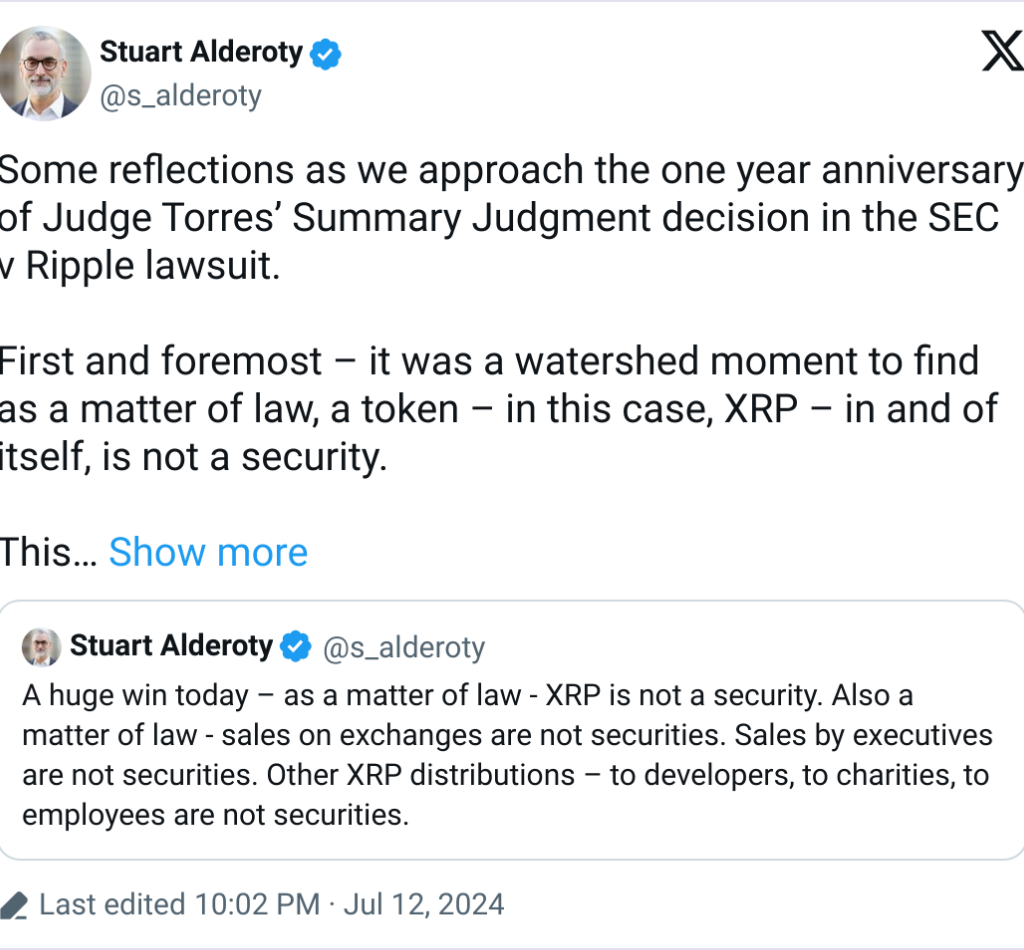

Stuart Alderoty, Ripple’s chief legal officer, emphasized the significance of Judge Torres’ ruling on the X platform. He noted that this decision has paved the way for other cases, including the recent Binance case, to recognize the SEC’s overreach and departure from legal principles under Chairman Gensler’s leadership. Alderoty stressed that relying on prolonged litigation to determine the status of each token on a case-by-case basis is unsatisfactory.

Implications for Regulatory Oversight

Stuart Alderoty, Ripple’s chief legal officer, reflected on the ruling on the X platform, highlighting the significance of Judge Torres’ decision. He noted that this ruling paved the way for other cases, including the recent Binance case, to recognize the SEC’s overreach and departure from legal principles under Chairman Gensler’s leadership. Alderoty emphasized that relying on prolonged litigation to determine the status of each token on a case-by-case basis is an unsatisfactory solution in the ongoing Ripple vs. SEC battle.

While the courts have provided a necessary check on the SEC’s actions, the regulatory environment remains complex and challenging. Over the past year, Ripple and the SEC have continued to engage in legal battles and negotiations. The SEC has not entirely backed down, and the Howey test, which determines whether a transaction qualifies as an “investment contract” under U.S. law, remains a critical aspect of the Ripple vs. SEC case.

Future of Ripple and the Crypto Market

The court’s ruling has positioned Ripple more favorably in the market, allowing the company to bolster its legal arguments and reinforce its position. The decision has also spurred policymakers on both sides of the aisle to push for more legislative progress on crypto regulations. As the U.S. continues to fall behind the rest of the world in this area, the need for clear and consistent regulatory frameworks becomes increasingly urgent, especially in the context of Ripple vs. SEC.

Despite the ongoing legal complexities, Ripple and the broader cryptocurrency industry have shown resilience. The court’s decision that XRP is not a security will not change, even as the SEC continues its efforts to litigate. Ripple and the entire industry have and will continue to emerge stronger, long after current regulatory leaders are gone.

The landmark ruling in the Ripple vs. SEC case has provided significant legal clarity for the cryptocurrency market. By establishing that XRP is not a security, the court has set a precedent that could shape the future of cryptocurrency regulation.

Leave a Reply