Table of Contents

Cryptocurrency payments have rapidly gained traction in the digital economy. Initially perceived as a niche market, digital currencies like Bitcoin and Ethereum have become mainstream, influencing various sectors including finance, e-commerce, and technology. The decentralized nature of cryptocurrencies offers an alternative to traditional banking systems, appealing to both consumers and businesses seeking more control over their financial transactions.

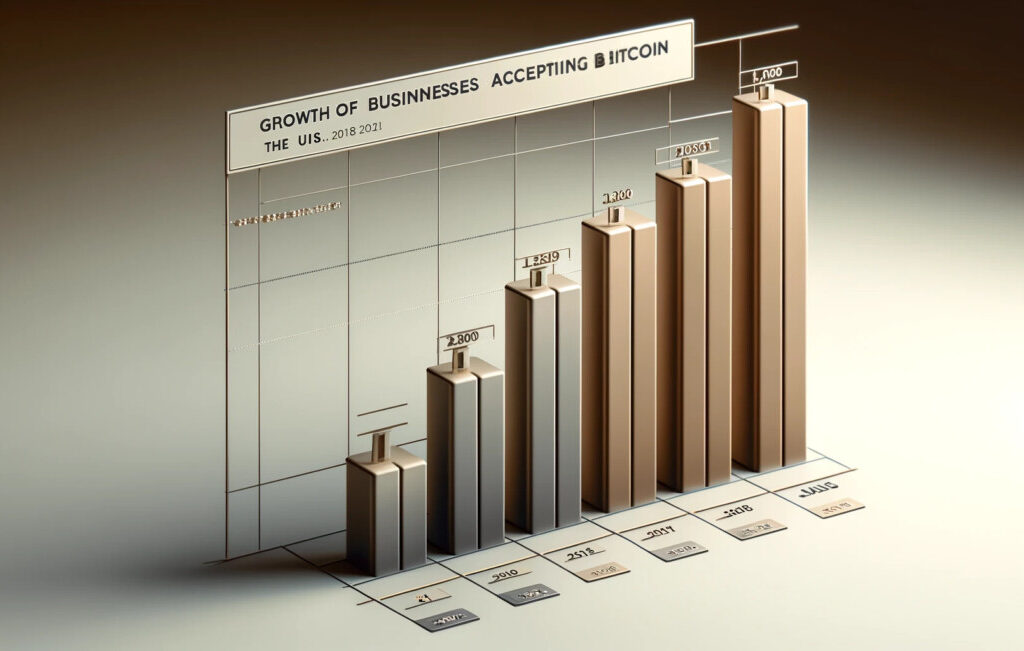

Statistics show a significant increase in the number of businesses accepting cryptocurrency payments. In 2020, approximately 2,300 businesses in the US accepted Bitcoin. This number has grown steadily as more companies recognize the potential of digital currencies.

Benefits of Accepting Crypto Payments

Accepting cryptocurrency payments offers several advantages for businesses. These benefits include:

- Lower Transaction Fees: Traditional payment methods often involve high transaction fees. Cryptocurrencies typically have lower fees, allowing businesses to save on costs.

- Faster Transactions: Crypto transactions are processed quickly, often within minutes. This speed is beneficial for both businesses and customers, especially in a global market.

- Increased Security: Cryptocurrencies utilize blockchain technology, which provides a secure and transparent way to conduct transactions. This reduces the risk of fraud and chargebacks.

- Access to a Global Market: Digital currencies are not bound by geographical limitations. Businesses can reach an international audience without the need for currency conversion.

- Customer Privacy: Cryptocurrencies offer a higher level of privacy compared to traditional payment methods. This can attract customers who prioritize their financial privacy.

For businesses considering this option, understanding how crypto payment gateways work is essential. These gateways facilitate the acceptance of digital currencies, making the process seamless for both the business and the customer.

Embracing cryptocurrency payments not only positions a business at the forefront of innovation but also caters to an increasingly digital-savvy customer base. For more detailed steps on how to start accepting cryptocurrency, refer to our guide on crypto payment gateway integration.

Understanding Crypto Payment Gateways

Crypto payment gateways are essential tools for businesses looking to accept cryptocurrency payments. These gateways act as intermediaries between the merchant and the customer, facilitating transactions in digital currencies. They convert the customer’s cryptocurrency into the merchant’s preferred fiat currency or allow the merchant to receive the payment in cryptocurrency directly.

The primary function of a crypto payment gateway is to ensure secure and seamless transactions. They provide various features such as transaction tracking, payment confirmations, and integration with existing e-commerce platforms. By using a payment gateway, businesses can expand their payment options and cater to the growing number of crypto users.

How Crypto Payment Gateways Facilitate Transactions

Crypto payment gateways streamline the process of accepting cryptocurrency payments by handling the complexities involved in digital currency transactions. When a customer decides to pay with cryptocurrency at checkout, the payment gateway generates a unique invoice with a specified amount in the chosen cryptocurrency. The gateway then provides a QR code or payment link for the customer to complete the transaction.

Once the customer sends the payment, the gateway verifies the transaction on the blockchain and confirms receipt. If the merchant prefers to receive fiat currency, the gateway converts the received cryptocurrency into the desired fiat currency. Finally, the converted funds or cryptocurrency are transferred to the merchant’s account. By understanding the role of crypto payment gateways, businesses can make informed decisions about integrating these systems into their payment processes.

The table below summarizes the key steps involved in a crypto payment transaction:

| Step | Description |

|---|---|

| Customer Initiates Payment | Customer chooses to pay with cryptocurrency at checkout. |

| Invoice Generation | Gateway generates an invoice in the chosen cryptocurrency. |

| QR Code/Payment Link | Gateway provides a QR code or link for payment. |

| Payment Confirmation | Gateway verifies the transaction on the blockchain. |

| Currency Conversion | Gateway converts cryptocurrency to fiat currency (if needed). |

| Funds Transfer | Funds are transferred to the merchant’s account. |

By understanding the role of crypto payment gateways, businesses can make informed decisions about integrating these systems into their payment processes. For more information on choosing the right gateway, check out our article on best crypto payment gateways. For Ethereum-specific options, visit our guide on ethereum payment gateways.

Setting Up Crypto Payments

Setting up cryptocurrency payments can open new avenues for businesses looking to embrace the digital economy. This section will guide you through the steps to start accepting cryptocurrency and key considerations when choosing the right payment gateway.

Steps to Start Accepting Cryptocurrency

- Educate Yourself: Understand the basics of cryptocurrency and how it works.

- Choose a Cryptocurrency Wallet: Select a secure wallet to store your digital assets.

- Select a Payment Processor: Choose a crypto payment gateway to facilitate transactions.

- Integrate Payment Gateway: Implement the chosen gateway into your existing payment system.

- Inform Customers: Let your clients know that you accept cryptocurrency payments.

- Test Transactions: Run test transactions to ensure everything works smoothly.

For detailed integration steps, refer to our guide on crypto payment gateway integration.

Considerations for Choosing the Right Payment Gateway

When selecting a payment gateway for accepting cryptocurrency payments, consider the following factors:

| Consideration | Description |

|---|---|

| Security | Ensure the gateway provides robust security features to protect transactions. |

| Supported Cryptocurrencies | Check which cryptocurrencies are supported by the gateway. |

| Transaction Fees | Compare transaction fees among different gateways. |

| Ease of Integration | Evaluate how easily the gateway integrates with your existing systems. |

| Customer Support | Look for gateways that offer reliable customer support. |

| Compliance | Verify that the gateway complies with regulatory requirements. |

For more information on top payment processors, explore our article on top cryptocurrency payment processors.

Choosing the right payment gateway is crucial for seamless crypto transactions. For options specific to Ethereum, visit our article on ethereum payment gateways.

Integrating cryptocurrency payments into your business not only enhances customer experience but also positions you at the forefront of the digital economy. For further insights, read about the best crypto payment gateways.

Popular Cryptocurrencies for Payments

When it comes to accepting cryptocurrency payments, it is vital to be familiar with the most common digital currencies used in transactions. This section covers three popular cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Bitcoin (BTC)

Bitcoin is the most well-known and widely accepted cryptocurrency. It was the first digital currency to be created and remains the leading choice for many businesses and consumers.

| Feature | Details |

|---|---|

| Symbol | BTC |

| Market Cap | $1.1 trillion (as of 2023) |

| Transaction Speed | ~10 minutes per block |

| Average Transaction Fee | $3-$4 |

Bitcoin’s decentralized nature and widespread adoption make it a reliable option for businesses looking to accept cryptocurrency payments. For more information on integrating Bitcoin into your payment system, visit our guide on crypto payment gateway integration.

Ethereum (ETH)

Ethereum is another popular cryptocurrency, known for its smart contract functionality, which allows for more complex and programmable transactions.

| Feature | Details |

|---|---|

| Symbol | ETH |

| Market Cap | $500 billion (as of 2023) |

| Transaction Speed | ~15 seconds per block |

| Average Transaction Fee | $10-$20 |

The versatility and growing ecosystem of Ethereum make it an attractive option for businesses. For more insights on Ethereum payment gateways, check out our article on ethereum payment gateways.

Litecoin (LTC)

Litecoin is often referred to as the “silver” to Bitcoin’s “gold.” It was created to provide faster transaction confirmation times and a different hashing algorithm.

| Feature | Details |

|---|---|

| Symbol | LTC |

| Market Cap | $10 billion (as of 2023) |

| Transaction Speed | ~2.5 minutes per block |

| Average Transaction Fee | $0.05-$0.10 |

Litecoin’s faster transaction times and lower fees make it a practical choice for day-to-day transactions. For more options on cryptocurrency payment processors, explore our list of top cryptocurrency payment processors.

Understanding these popular cryptocurrencies can help businesses make informed decisions about which digital currencies to accept. For further information on choosing the right payment gateways, refer to our guide on the best crypto payment gateways.

Managing Cryptocurrency Payments

Managing cryptocurrency payments involves several key steps to ensure smooth transactions and effective control over the process. Here’s a comprehensive guide to help businesses manage cryptocurrency payments efficiently.

Setting Up a Cryptocurrency Payment Gateway

The first step in managing cryptocurrency payments is setting up a payment gateway. This technology solution processes transactions between customers, merchants, and crypto networks. Choosing the right gateway is crucial. Some of the best options include:

- Coinbase Commerce: Known for its easy integration and support for multiple cryptocurrencies, it offers custom checkouts, invoicing, and volatility shielding.

- BitPay: Excellent for avoiding price volatility, it provides features like fiat settlement and invoicing.

- NOWPayments: Preferred for low transaction fees and flexible settlement options.

Each of these gateways offers unique benefits, so selecting one that aligns with your business needs is essential.

Integrating and Monitoring Transactions

Once the payment gateway is set up, integrating it with your website is the next step. This involves adding cryptocurrency payment options at checkout, generating unique wallet addresses, and configuring conversion settings to either retain crypto or convert it to fiat currency immediately.

Transaction monitoring is vital for verifying the authenticity of incoming funds. Develop strict accounting practices to record transactions accurately and ensure compliance with tax and regulatory authorities. Regularly reconcile transactions with orders or invoices to maintain financial integrity.

Security Measures for Crypto Transactions

Security is paramount when dealing with cryptocurrency transactions. Due to the decentralized nature of cryptocurrencies, ensuring the safety of transactions is vital.

| Security Measure | Description |

|---|---|

| Multi-Signature Wallets | Requires multiple keys for transaction authorization |

| Two-Factor Authentication | Adds an extra layer of security for account access |

| Regular Software Updates | Protects against new vulnerabilities |

| Cold Storage | Offline storage for large amounts of cryptocurrency |

For more detailed information on integrating secure payment gateways, refer to our guide on crypto payment gateway integration.

Accounting and Tax Implications

Accepting cryptocurrency payments also entails specific accounting and tax responsibilities. Businesses must be aware of how to properly account for and report these transactions.

- Record-Keeping: Maintain detailed records of all cryptocurrency transactions, including the date, amount, and value at the time of the transaction.

- Valuation: Cryptocurrencies must be valued at their fair market value in USD at the time of the transaction.

- Reporting Requirements: Businesses must report cryptocurrency transactions according to local tax laws. This may involve reporting gains or losses from cryptocurrency holdings.

- Software Tools: Utilize accounting software that supports cryptocurrency transactions for accurate record-keeping and reporting.

| Consideration | Description |

|---|---|

| Record-Keeping | Detailed records of all transactions |

| Valuation | Fair market value in USD at the time of the transaction |

| Reporting Requirements | Compliance with local tax laws |

| Software Tools | Use of accounting software for accurate records |

To learn more about the best payment processors for handling cryptocurrency transactions, visit our article on top cryptocurrency payment processors.

Understanding these aspects of managing cryptocurrency payments ensures businesses can confidently accept digital currencies while maintaining security and compliance.

Leading Crypto Payment Gateways in India for 2024

Crypto payment gateways facilitate transactions using cryptocurrencies, offering a secure, fast, and cost-effective alternative to traditional payment methods. They integrate into websites and apps, allowing merchants to accept cryptocurrencies like Bitcoin, Ethereum, and stablecoins.

Top Crypto Payment Gateways in India

- BTCPay Server

BTCPay Server is a fully open-source payment processor that can be self-hosted, eliminating intermediaries. It integrates with platforms like Shopify and WooCommerce. However, it lacks fiat settlement options, exposing businesses to cryptocurrency volatility. - CoinsPaid

CoinsPaid offers a comprehensive suite of crypto payment solutions, supporting over 20 cryptocurrencies and 40 fiat currencies. It features robust security measures and a user-friendly interface, catering to high-volume transactions with lower fees compared to traditional banking. - NOWPayments

NOWPayments supports over 300 cryptocurrencies and offers features like subscription payments, mass payouts, and invoicing. It charges competitive fees of 0.5% for standard transactions and 1% for multi-currency transactions. - Confirmo

Operating for over a decade, Confirmo is known for its reliable service and Lightning Network integration, allowing cost-effective Bitcoin transactions. It charges a 0.5% processing fee plus a fixed withdrawal fee. - Solana Pay

Solana Pay leverages the Solana blockchain to provide fast, low-cost transactions, primarily accepting stablecoins. It integrates with Shopify and supports loyalty programs through NFTs and tiered discounts.

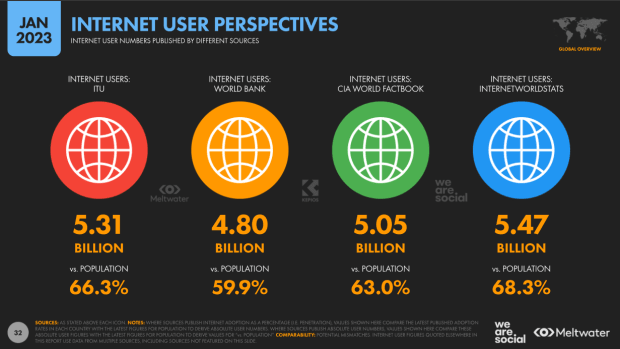

Benefits of Using Crypto Payment Gateways

- Global Acceptance: Crypto gateways enable global transactions without relying on traditional banking systems, making them accessible to anyone with internet access.

- Fast and Easy Transactions: Blockchain technology ensures quick transaction processing, reducing delays common with traditional methods.

- Lower Transaction Fees: Crypto transactions generally incur lower fees, benefiting both businesses and customers.

- High Privacy: Users can make payments without disclosing personal information, enhancing privacy.

Case Studies in India

- Ardor 2.1: This New Delhi restaurant offers a unique dining experience, allowing customers to pay for their “Digital Thali” with Bitcoin, enjoying a 20% discount.

- Heptagon: An IT solutions provider that accepts Bitcoin and other cryptocurrencies, reflecting its commitment to modern technology and client flexibility.

- Cloudlean: A cloud infrastructure provider that supports Bitcoin and Ethereum payments, ensuring high uptime and personalized support.

Future Trends in Crypto Payments

In 2024, merchant adoption of cryptocurrencies is set to increase significantly. Technologies such as POS machines introduced by companies like Blocktrade enable cryptocurrency transactions in under 10 seconds, making crypto payments more feasible in everyday commerce. Notably, the number of merchants accepting Bitcoin surged by 174% in 2023, reaching approximately 9,926 globally. This growth is supported by a rising number of users, with over 420 million crypto users worldwide.

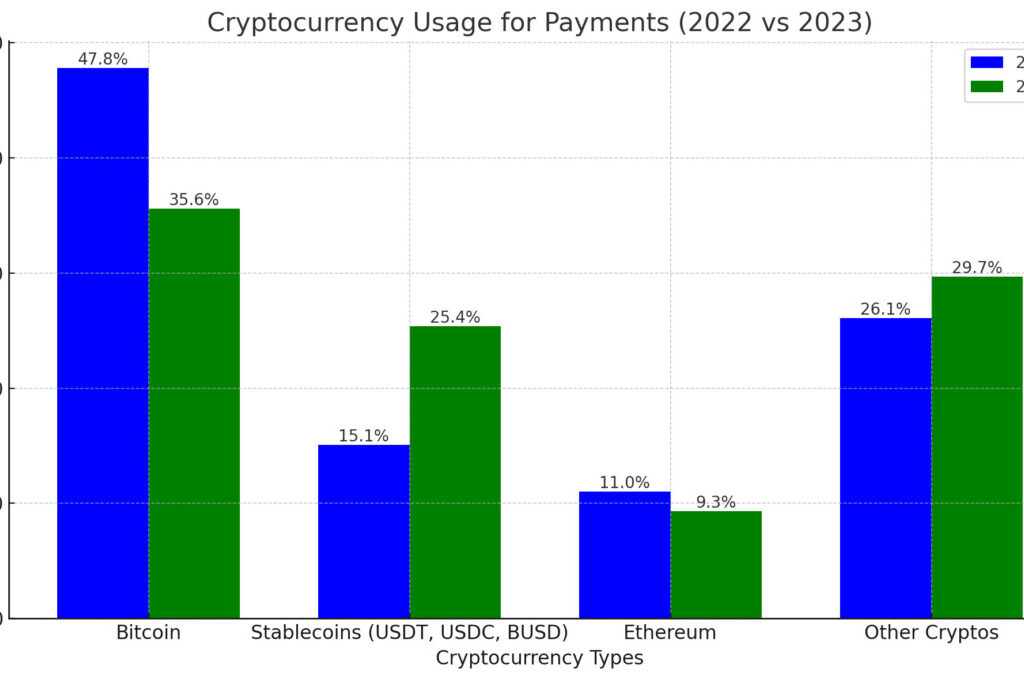

Growth of Stablecoins

Stablecoins, pegged to traditional assets like the U.S. dollar, are becoming increasingly popular due to their reduced volatility. Major stablecoins such as Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) are leading this trend. In 2023, USDT transactions made up 25.4% of all payments processed through CoinGate, a significant increase from 15.1% in 2022. This rise underscores the growing preference for stablecoins in cryptocurrency payments.

Development of Central Bank Digital Currencies (CBDCs)

Central banks worldwide are exploring or developing their own digital currencies, known as CBDCs. These digital fiat currencies could significantly impact the crypto payment landscape by providing a regulated and stable alternative to traditional cryptocurrencies. The introduction of CBDCs could enhance the credibility and adoption of digital payments globally.

Enhanced Security Measures

Security remains a top concern in crypto payments. Innovations in biometric authentication and fraud prevention are expected to improve the safety of peer-to-peer transactions and overall crypto usage. These advancements aim to reduce scams and phishing attacks, making crypto payments more secure and trustworthy.

Integration with Fintech and Neo-Banks

Fintech applications and neo-banks are increasingly incorporating cryptocurrency support into their platforms. This integration facilitates easier and more widespread use of crypto for everyday transactions, further driving mainstream adoption. In 2023, Swapin facilitated over €82 million in transactions for 18,500 customers, exemplifying the growing integration of crypto in financial services (Finbold).

Social Media and E-Commerce Integration

Social media platforms are becoming significant players in the payment ecosystem, allowing users to make purchases directly within apps like Facebook, TikTok, and Instagram. This trend extends to cryptocurrency payments, where users can discover and buy products seamlessly through social media. The rise of social commerce highlights the growing intersection of social media and payment technologies.

As the adoption of cryptocurrency continues to rise, businesses must consider integrating crypto payment gateways to stay competitive. For more information on choosing the right gateway, visit our article on best crypto payment gateways.

Innovations in the Crypto Payment Industry

The cryptocurrency payment industry is evolving rapidly, driven by innovations that enhance transaction efficiency and user experience. Key developments include the Lightning Network, stablecoins, Decentralized Finance (DeFi) platforms, and cross-chain solutions.

The Lightning Network

The Lightning Network is designed to facilitate faster and cheaper transactions on the Bitcoin network. By creating a second layer on the blockchain, it enables instant payments with minimal fees, making Bitcoin more viable for everyday transactions. This network significantly reduces congestion on the main blockchain, allowing for quicker confirmation times and lower transaction costs. As of 2024, the Lightning Network has expanded, with more businesses and services integrating this technology to streamline Bitcoin payments.

Stablecoins

Stablecoins are cryptocurrencies pegged to stable assets like the US Dollar, reducing the volatility typically associated with digital currencies. This stability makes them more suitable for everyday transactions and financial operations. Examples include Tether (USDT) and USD Coin (USDC), which are widely used in the crypto payment ecosystem. The adoption of stablecoins provides a more predictable value for transactions, encouraging both consumers and businesses to embrace cryptocurrency payments without the fear of sudden value fluctuations.

Decentralized Finance (DeFi) Platforms

DeFi platforms offer financial services such as lending, borrowing, and trading without intermediaries. These platforms are increasingly integrating payment solutions, allowing users to transact directly from their DeFi wallets. Innovations in DeFi have led to the creation of decentralized exchanges (DEXs) and automated market makers (AMMs), which provide liquidity and enable seamless transactions within the crypto ecosystem. DeFi platforms like Uniswap and Aave have grown significantly, providing more options for users to manage and utilize their cryptocurrencies.

Cross-Chain Solutions

Cross-chain solutions enable interoperability between different blockchain networks, facilitating seamless transactions across various cryptocurrencies. Technologies such as atomic swaps and blockchain bridges allow users to transfer assets between different blockchains without the need for a centralized exchange. These innovations enhance the flexibility of crypto payments, making it easier for users to transact with multiple cryptocurrencies. Projects like Polkadot and Cosmos are at the forefront of developing cross-chain technology, aiming to create an interconnected blockchain ecosystem.

Enhanced Security Measures

Innovations in security measures are crucial as the crypto payment industry grows. Multi-signature wallets and hardware wallets provide enhanced security for storing and transacting cryptocurrencies. Multi-signature wallets require multiple keys to authorize a transaction, adding an extra layer of protection. Hardware wallets, such as those from Ledger and Trezor, store private keys offline, safeguarding against online threats. These security advancements are essential in building trust and encouraging broader adoption of cryptocurrency payments.

NFT Integration

Non-fungible tokens (NFTs) are also making their way into the payment industry. Some platforms now allow users to pay for goods and services using NFTs, broadening the utility of these digital assets beyond mere collectibles. This integration signifies the growing convergence of different blockchain technologies, providing more diverse use cases for cryptocurrencies.

These innovations are transforming the way businesses and consumers interact with cryptocurrencies. By staying informed about these trends, businesses can effectively navigate the digital economy and capitalize on the advantages of accepting cryptocurrency payments. For insights on integrating these technologies, explore our guide on crypto payment gateway integration.

Leave a Reply