NAIROBI (CoinChapter.com) — U.S. President Donald Trump unveiled his second-term “America First” agenda, focusing on public safety, energy independence, and government reform. However, the absence of cryptocurrencies from the priorities raised questions, given his earlier promises to embrace digital assets, including a strategic Bitcoin reserve.

Crypto Absent from ‘America First’ Agenda

Trump’s Jan. 20 briefing emphasized traditional economic reforms, omitting any mention of digital assets or his previously suggested strategic Bitcoin reserve. Despite campaign rhetoric hinting at pro-crypto policies, his administration has yet to outline its stance on the industry.

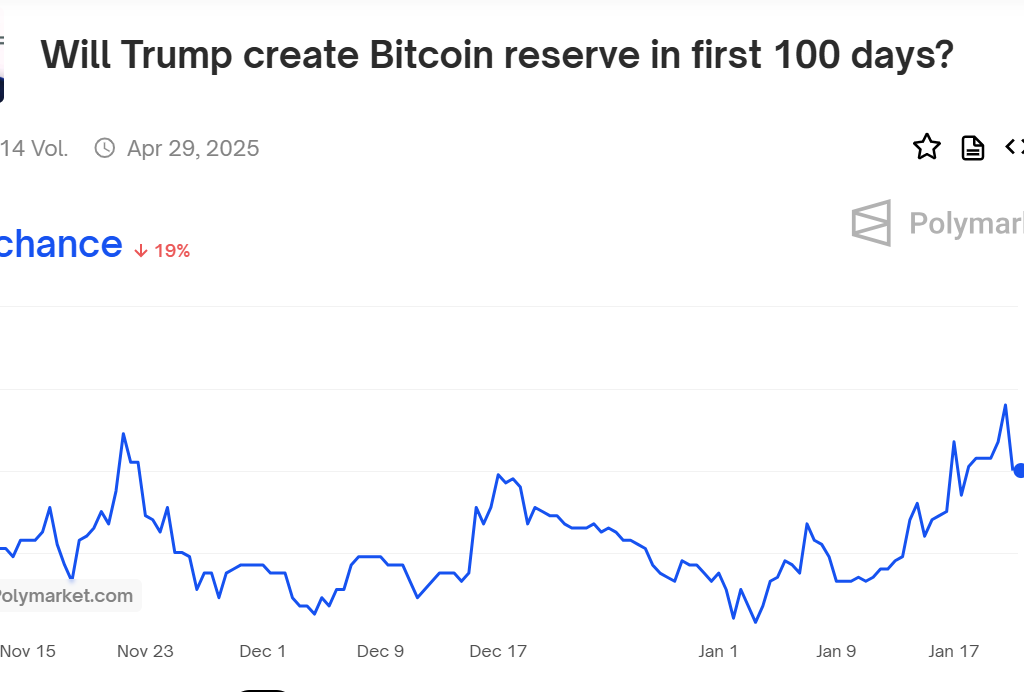

Betting markets remain optimistic about future developments. Polymarket bettors estimate a one-in-three chance of a strategic Bitcoin reserve within Trump’s first 100 days, while Kalshi predicts a 40% likelihood by year-end.

Bitcoin Hits $109,000 Amid Market Frenzy

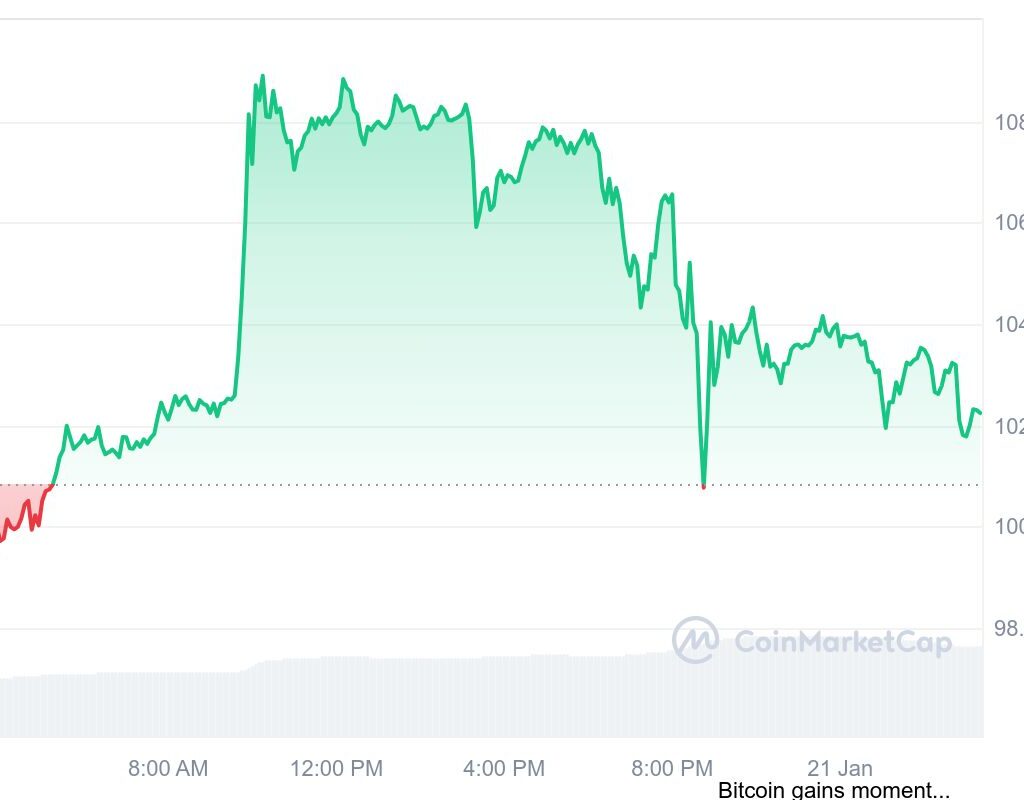

Bitcoin soared to an all-time high of $109,000 during inauguration week, driven by expectations of favorable crypto policies. The rally, a 50% surge since Trump’s election, highlights market anticipation for regulatory clarity and institutional support under his leadership.

Adding to the excitement, Trump’s TRUMP memecoin on Solana surged 490% in its first day, reaching an $11 billion market cap. The launch drew mixed reactions, with critics questioning the long-term viability of politically themed tokens.

Strategic Bitcoin Reserve Still in Play?

Despite the omission of crypto in Trump’s priorities, the industry remains optimistic. Analysts argue that a Bitcoin reserve aligns with Trump’s nationalist agenda, potentially solidifying the United States’ position in global digital finance. The crypto community will closely monitor his administration for signs of policy shifts as markets continue to rally.

Leave a Reply